The number one question I get asked is, how to create your own Forex strategy? Have you always wanted to know how easy it is to create your very own working strategy. If so, then you’re in the right place!

You can create your own Forex strategy with following these 11 steps, with forming your market ideology with understating how the markets move. Choosing the right time frame, for day trading or as a Forex swing trader. Knowing which pairs to trade and defining your risk, with using technical indicators to show a pairs trend.

Define your entry and exits with creating a Forex trading plan, with making sure you follow the plan. Finally, back testing and demo trading before going live with your strategy.

The main purpose of this trading lesson, is to guide you through the process of how you can create your own Forex trading strategy. While creating a strategy doesn’t take that long, actually testing and defining the strategy to be profitable will take time.

Why does this matter?

This will matter, as you will find in this article I’ve written on developing your own perfect Forex trading strategy, to be robust and profitable in all market conditions. Is going to take patients and determination to see the fruits of your labour. The majority of new or beginner traders will start of their trading journey with using other traders strategies. I mean this is exactly how I got started as well.

One piece of advice I can offer you from the get go, is to have realistic expectations. I mean, don’t go thinking right out of the box that you’re going to become rich with your strategy. Thinking like this is going to set you up for a hard fall.

Creating a Forex strategy might be easy, but finding that edge over the markets is not!

So, how can I create my own Forex strategy I hear you ask? With following these 11 steps to creating a Forex strategy;

- Understand The markets and form your ideology

- Choosing the correct time frame

- Finding the right currency pairs to trade

- Use of an added aide to show the trend

- Define your risk

- Define your entry trigger

- Plan your exit rules

- Create a Forex trading plan and follow it!

- Back testing

- Demo trading

- Live trading

Step #1 : Understand The Markets & Form Your Ideology

Something you need to do, right of the bat with how to create your own Forex strategy. Is to consider what do you really know about Forex trading and how the markets actually move. As the image suggests “thoughts are free!” So develop an idea of how the markets move and then research to find out exactly what moves price on the chart.

You can form your market ideology with reading both technical and fundamental analysis, to give you an idea of how they can effect the outcome of the market movements.

You’re going to be able to learn from this article I’ve written all about the difference between support and resistance. How it’s going to increase your win ratio by 35% when you add it into your own trading strategy. You’re also going to need to avoid at all costs anything that relates to get-rich-quick claims.

Your market ideology, will be what makes or breaks how to create your own Forex strategy. So make sure you give it the attention it deserves, to be successful you have to think of success. Make sure you don’t over complicate things, keep it simple as you don’t want to be overwhelmed by a Forex strategy too complex. Making it harder for you to follow the plan and trade the plan, and making it harder to improve!

Lets now move on to the next step, with how you can choose the right time frame to trade for you.

Step #2 : Choosing The Correct Time Frame

The first thing you need to decide after thinking through your ideology, with a recent article I’ve written. Is all about the 4 different types of trading as a beginner you could start today, with what type of trader are you?

Why does this matter?

This will make a considerable difference to your Forex trading strategy outcome. You have to ask yourself are you a day trader or a swing trader. If you see yourself as a day trader, you will be wanting to create your Forex strategy based around the smaller time frames such as the 5 min or 15 min charts.

If you see yourself as a swing trader, then you would be looking at trading the higher time frames. Such as the Daily and Weekly charts. Perhaps even as low as the 4-hour time frame. If you see a Forex swing trading style for you, and don’t have the time right now to create your own Forex strategy.

Then it will be a perfect opportunity for you to read my latest article I’ve written. All about a Forex swing trading strategy and the best part is to get my guide for swing trading for free by clicking here.

So you see, the type of trader you are will effect the right time frame choice for your Forex strategy. A way to determine what type of trader you are;

- Do you look at the charts every hour, day, week or even month?

- How long do you want to hold your positions open for?

- Do you work full time, part time or not at all?

Answering some of these simple questions, will give you a better idea of your traders persona. And give you a better idea of what time frame you should choose for your Forex strategy.

Step #3 : Finding The Right Currency Pairs To Trade

Just as important as finding the right time frame to trade, with how to create your own Forex strategy. Finding the best currency pairs to trade with your Forex strategy, is what’s going to make or break your trading results.

Why does this matter?

Depending on the type of trading style you are looking to trade, this will also have a high impact on the currency pair you trade. This is because of some pairs (mainly exotic) can have considerably higher spread rates and swaps.

So, if you are a day trader, perhaps scalping the markets. To trade this type of trading you are only going to want to stick to lower spread currencies. Such as;

- EURUSD

- GBPUSD

- USDCHF

- USDCAD

- USDJPY

Where if you where to create a Forex strategy for a swing trading type of trading. You are opening up the option to trade more currencies, and some exotic pairs that you perhaps cannot trade when day trading.

Other concerns may be your time zone, where you currently reside. If you live in the UK, and only follow the British economy news with fundamentals. You may then only want to trade GBP cross currencies. Taking into account a currency personality, not all currencies will move and behave in the same way.

So further investigation of each single currencies personalty may be required to know which best suit your needs and your Forex strategy needs.

When it comes to how can i create my own Forex strategy, you need to really consider which pairs you will want to include. Within your basket of traded pairs with your strategy. Picking the wrong ones here, could very well be what denies you the success rate you are looking for.

Step #4 : Use Of An Added Aide To Show The Trend

Your next step with how to create your own Forex strategy, with being able to take all potential from a trade, is to trade in the direction of the trend. You wouldn’t just trade a bearish engulfing candle anywhere. You would look to logically trade it with a bearish trend coming off a swing high. If you want to learn how to trade the bearish engulfing candle successfully, check out the article I’ve written by clicking here.

Since one of your goals with creating your own Forex strategy should be to trade with the trend. You will need to use what is called a Forex indicator to find and spot trends more easily. If you want to find out why I dislike the use of indicators, and how it can improve your trading 10 fold. You can find out more from a recent article I’ve written by clicking here.

Further more, check out in this article I wrote on why I removed all technical indicators from my charts, and why you should too to improve your trading. But to help you today with how to create your own Forex strategy, I am going to share with you the no.1 indicator you should use to find trends more easily.

The best part?

To learn more on this trend indicator, and why I think it’s the best one to use when creating your own strategy. Check out my new article on a perfect Forex strategy with using the moving average by clicking here.

That’s right, the trend indicator that I suggest is the moving average. The moving averages is one of the most popular indicators that traders use to spot trends in the markets with ease. But I am not suggesting the use of two moving averages with a cross over.

Using them in this way is going to crush your results with your Forex strategy. I personally have a much better option that I am going to share with you now. This is to use two Exponential moving averages to find what is called an area of dynamic support or resistance.

After the two ema’s have crossed over and heading in a upwards or downwards direction is when you will identity the trend direction.

Here’s what I mean:

See how using these two moving averages, you could have seen the steepness of the upwards movement in line together to show a bullish trend. This will now give you an added aide to see when a pair is trending at a quick glance.

Now you have a cool way of finding trends in the markets, it’s important to make sure you know how to define your risk.

Step #5 : Define Your Risk

When developing your own Forex strategy, it is going to be very important you define how much you are willing to lose on each trade you take.

When it comes to how to create your own Forex strategy, the importance of understanding risks involved with trading. Should be at the top of your to do list, not many new traders actually like to talk about losing in Forex. Where this should be the top thought process you go through, before entering each new trade.

The amount you are willing to lose will be different for each trader. And good money management is going to be crucial to your trading success. You could also use a lot size calculator to calculate each trade you take. This will then show you exactly what you will lose on the trade if it does in fact lose.

If you need a good lot size calculator, I have a totally free one you can use when creating your own Forex strategy by clicking here.

You should look to trade with a fixed percentage on each trade you take, this will eliminate any emotions within your trading as well. So to sum it up, make sure you know ahead of time how much you are willing to lose.

Step #6 : Define Your Entry Trigger

Even with having the best market context, you are still going to need some kind of an entry trigger for your trades. This will then remove all emotions and help you to enter the trade without any hesitation.

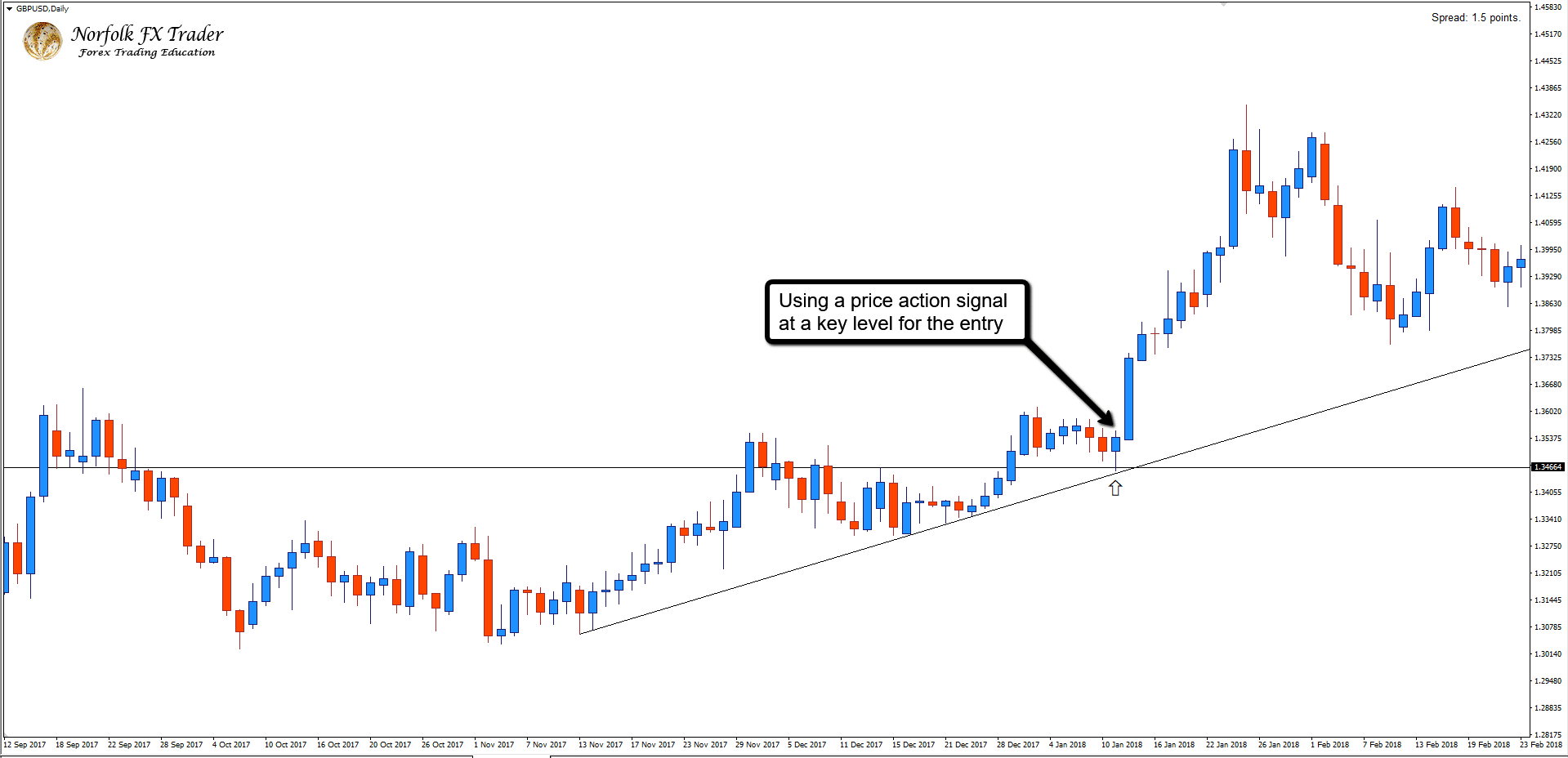

There are going to be many different ways for you to define an entry trigger. Some traders like myself, use candlestick patterns in conjunction with support and resistance as a trigger. For an example, the chart below demonstrates a entry trigger after the bullish rejection candle bounced of a broken resistance acting as a support.

Where others will like the use of indicators to confirm the entry on their trades as the trigger. You will have a wide range of different indicators you can pick from to use as your trigger. With creating your own Forex trading system. One of the most common used indicators for a trigger is the stochastic oscillator;

Other entry triggers that you might use, are when price closes a level, like on a break of a trend line or a level of support or resistance. Many traders may also take an entry trigger once all of their indicators line up. Where others may prefer to wait for the current candle to close to confirm the trigger.

This is my preferred type of trigger, is to always wait for the current open candle to close before taking a trade. Using this one technique with how to create your own Forex strategy, is going to stop you getting caught up in fake breakouts.

Once you have the entry trigger planned, you then need a exit trigger.

Step #7 : Plan Your Exit Rules

Planning your exits in advance, not only takes away the emotions in trading. But also lets you know how to close a position when the market takes a turn against you! You will need to have a plan in place to know when to exit when things go wrong.

Why does this matter?

Because the market can at anytime go against you causing you losses beyond your imagination. This is why it is critical to always use a market stop loss.

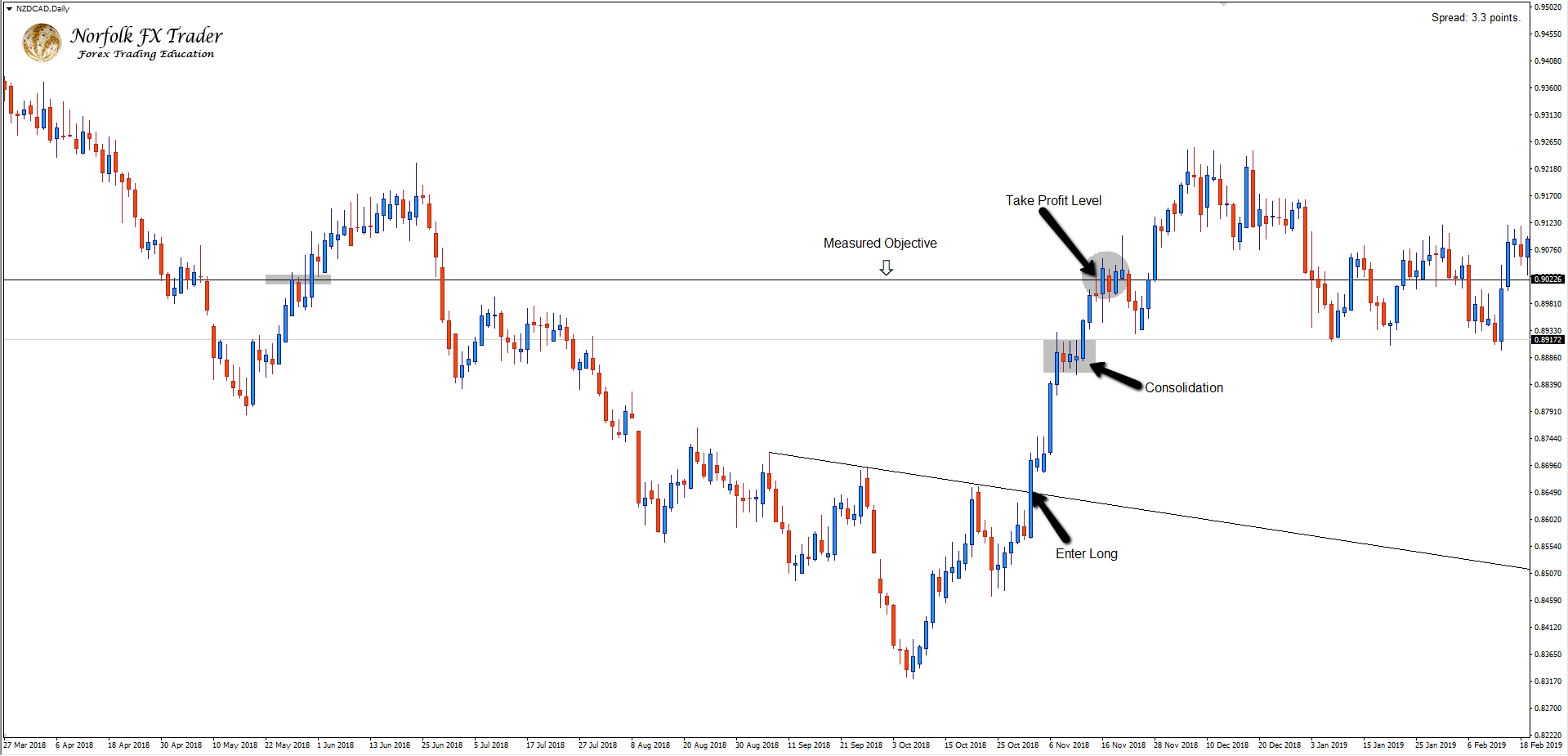

As well as exit triggers to close your trade when things go wrong, you are also going to need exit triggers when things go your way! This of course, is having logically placed targets. Targets can be placed in advance, waiting for this to be hit when the trade continues with the trend.

There are a few types of target exit triggers you could use, such as;

- Price levels

- Fibonacci targets

- Supply and demand zones

- Channel tops and bottoms

- Objective targets (Example below)

The final way you could use a exit trigger, is to use a trailing stop. Meaning if price was to move in your favour for X amount, you would move your stop X amount until stopped out.

Step #8 : Create A Forex Trading Plan & Follow It!

Perhaps one the most important steps of all with how to create your own Forex strategy. Is to also create a Forex trading plan, which you can find out more in a new article I’ve recently written on how to create a Forex trading plan. A trading plan will provide you with rules to follow and allow you plan ahead of time. Your plan should include written guidelines to follow, and of course trade management rules with your trades.

Things you will need to include in a Forex trading plan;

- To cover each possible scenario you may come across

- A checklist you can follow

- Written guidelines

Using a Forex trading plan, will give you the skills to evaluate each trade before you use an entry trigger ahead of time. And when ever you are not in a trade, using a plan will not let you get influenced by the markets. Allowing you to keep your emotions in trading under control.

Step #9 : Back Testing

Back testing your created Forex strategy, will not only let you see how the strategy will perform in past history. It will also allow you to gain experience with chart time using a Forex strategy.

Back testing is also a way to speed up your learning curve with knowing if your Forex strategy is worth pursuing, to move to live or demo trading. I mean, how to create your own Forex strategy without really testing it first to make sure it performed will in all market conditions.

Another added bonus, when using back testing with your created Forex strategy, is it will allow you to perfect your trading. With allowing you to practice without any pressure, as with live market conditions.

Of course this will never replace testing your Forex strategy in either a live demo trading account or going live. But, it is going to be the best step to take at this point of creating your own Forex trading system.

Step #10 : Demo Trading

Using a live demo account is going to be a great next step with the testing of your created Forex strategy. Not to mention it is going to allow you to gain more chart experience. Demo trading is also going to allow you to gain more confidence in your Forex strategy.

The use of a live simulated demo account, is also going to get you as close as to live market conditions without actually trading Live! I would suggest, to at least use a demo account to test your Forex strategy for a period of 3-6 months. This will give you enough data to know if it will perform over time.

Using a demo trading account, will also help dramatically with your trading emotions and trade psychology. The use of a demo account will allow you to see what possible draw downs your Forex strategy may bring.

Therefore allowing you to see and feel how you will react to losing periods with your Forex strategy that you have now created before going Live.

Step #11 : Live Trading

Finally now is the right time to start trading with your created Forex strategy in live market conditions. But, Your first trading strategy will most probably not be profitable. But it’s okay. Your trading strategy is a living object, it is not static.

With your growing experience and knowledge, your trading strategy will improve over time as you make tweaks until it is working to it’s fullest potential. But make sure you avoid any drastic changes to your strategy, and plan to take notes even chart screen shots of market observations.

For this final step (which might take forever), remember that your aim is to achieve positive expectancy with every trade. Not positive profits for each trade.

Let statistics work for you, don’t force your will on the market.

Wrapping Things Up

Follow the 11 steps above with how to create your own Forex strategy, and you will find yourself with a basic trading strategy.

You now will have a better understanding of the markets and form your ideology. You should now know what time frame will be the right choice to your circumstances and which pairs to trade.

Remember to follow the trend with your Forex strategy, this will give you more consistency. Defining your risk is the most important part to any traders tools. Also you now should know how to determine a entry and exit trigger with your strategy.

Now create a Forex trading plan around your Forex strategy, making sure you back test and demo trade the strategy before you move to live trading.

Remember, This strategy is not the Holy Grail, but it is formed with your experience and according to your trading style and personality.

Click here for more trading lessons