Have you been searching for the perfect Forex trading strategy, and are in desperate need of help and a strategy you can rely on. If so, then you’re in the right place!

What is that top Forex trading strategy to start using today?

The perfect Forex trading strategy, is going to be a strategy trading with the trend. To better time your trade entries and to identify the best markets to trade. Adding the moving averages as shown below will greatly improve your success rate as a trend trader.

It’s hard finding a strategy that you feel confident about, let alone one that actually performs and makes you profits in the markets! So in today’s lesson I’m going to be sharing with you what you need to do to feel more confident instead…

With: Using the moving average perfect Forex trading strategy

- How to use moving averages to trade with the trend

- How you can use moving averages to identify value areas to trade in the market

- Plus how you can use moving averages to better time your entries

- How using this one simple trick you can use moving averages to identify the best markets to trade

- Using moving averages in a Forex trading strategy to capture big trends (Full working strategy)

My Story With Indicators & A Perfect Forex Trading Strategy

You should know that I only trade price action by now… I mean, if you don’t where have you been hiding this past year… under a rock! I’m no big fan of using indicators with my trading. But, I’m sure you have in the past, been sucked into the world of indicators and how they would give you profits beyond your dreams!

In fact…You can read one of my previous lessons I wrote on why I removed all technical indicators by clicking the link below…

“Why I removed all Forex technical indicators (why you should too)”

To be honest, I wasn’t a moving average fan in my early years of trading. I mean, back then my thoughts on the moving average was the same with all indicators, being… “Indicators are useless because they are all lagging.” But since then I have come to understand using the moving average as part of a perfect Forex trading strategy.

I can tell you, I was wrong! The moving average is one of the most versatile trading indicators I’ve come across, and it can be used in different ways you never thought possible. So if you’re ready lets get started with my moving average Forex trading strategy!

How to use moving averages to trade with the trend

I’m sure you already know how to determine if there is a trend in play. Lets take a downtrend as an example. For there to be a downtrend in the markets there has to be lower highs and lower lows, right?

But… sometimes you get a higher high in a downtrend, so does this mean the trend is over? Perhaps the best way for me to demonstrate this, will be with a chart example.

On the above chart, you will see this pair has been in a long time bearish trend on the 4-hour time frame. Lately, price had been moving sideways. But… the trend was still making new lows, until the last section of price, where it made the higher high and higher low.

Does this now mean the bearish trend is over?

Here’s the thing, just because there was a higher high and high low made, it doesn’t mean the trend is over.

Or that the trend has changed!

As you will see from the chart above, price in fact continued to drop another further 190 pips lower. So, your probably thinking how can I determine when a trend is or isn’t actually over! Well, you could use the moving average indicator to help you.

Here’s how to do it… If the price is below the 100 EMA and the 100 EMA is pointing downwards, then the market is in a long-term downtrend.

The opposite would be true for a up trend market. In the example below of the same chart, see how price remains below the 100 EMA and the EMA is pointing downwards.

And… if the market is below the 20 EMA and it is pointing down, then the pair would be in a short term down trend. The opposite would be true, with an up trend.

Hopefully this perfect Forex trading strategy is making sense?

And… you can see how using just these two EMA’s you would be able to determine: if the pair is in a long term trend or a short term trend.

Adding another moving average, so you have two on the chart, will allow you to gauge the strength of the trend. You see, when I said at the beginning of this lesson how using the moving average, is one of the most versatile trading indicators.

I wasn’t wrong! You can gauge the strength of a trend by looking at the steepness of the two EMA’s. The steeper the EMA’s, the stronger the trend. And the flatter the EMA’s, the weaker the trend.

Here’s what I mean:

To understand this technique further, check out my video with using the EMA’s to filter trends and consolidating periods in the markets.

Using moving averages as an area of value

A Moving average perfect Forex trading strategy at an area of value

Now: you might be asking yourself which is going to be the best moving averages to use. As an area of value on the charts.

Here’s the thing…when it comes to choosing an moving average there isn’t really a right or wrong moving average you should use. Rather, you need to find something that’s aligned with your trading approach.

Now: you’ve already got an idea of what you could use if you are a long term trend trader with using the 100 EMA. Same applies if you are a short term trend trader, you could use the 20 EMA. Personally I use the area of value between the 10 & 20 EMA.

You could really use any combinations of any EMA’s you want. This is just to give you an idea of what you need to be looking for.

Here’s and example:

One more point to make. Is, you will only want to use this area of value in market trends. You will want to avoid any consolidating or choppy markets.

The Use Of Moving Averages To Better Time Your Entries

So, I’ve now covered how using moving averages can help you to determine trends.

With:

- A long term trend

- A short term trend

- The strength of the trend

And…How using moving averages will indicate an area of value on your charts.

What I’m about to share with you will greatly improve your trading entries with a perfect Forex trading strategy

You’ve most probably already realised the power of using the EMA’s can help you assist finding trends in the market.

But, did you notice how using the area of value can act as a dynamic area of support or resistance? If you didn’t, take another look at the example I posted above.

Did you see it this time? Just like a rubber band, the market will snap back if it’s stretched too far away from the area of value.

“How does this help with my trading entries?”

Think about it like this, when the market becomes overextended, it’s going to pull back to the EMA’s. Just as it did on the example above on the last three occasions.

So… it’s going to be best not to try and take trades when price is far away from the EMA’s. Instead; only look to trade, when the market makes the pull backs into the area of value the EMA’s.

Lets take a look at another example of this:

It makes sense, right? Look back at your trades you have taken that lost. These where derived from trading far away from the moving averages. So, you will want to always look to take your trades at this area of value, when trading with the trend.

Using A Moving average perfect Forex trading strategy: to Identify the best markets to trade

Imagine…

There is a fight between the incredible Hulk and yourself! Who is likely to win?

The Hulk of course, he’s the strongest!

Now: you’re probably wondering… what the heck does this have to do with trading? Everything!

Let me explain: If you want to long the market you’d want to long the strongest market. And… if you want to go short, you’d want to short the weakest market. In other words… this will allow you to capture the strongest movements within the markets. With a higher probability of the trade working out.

So, how do I pick the best markets to trade?

Simple: You would need to determine the strength to weakness of a currency pair.

Now, there are many ways this could be done, in fact I’ve seen various indicators etc. available now for this. But, it remains that the easiest way to determine the relative strength of a market is to use the EMA’s. To make it easier for you below is my step-by-step process to find the strongest markets to trade.

Step #1

Pick markets that have the same base currency. So, if you are looking to trade the USD currency. You will need to look at all cross pars to that currency.

Like: EURUSD; AUDUSD; GBPUSD; NZDUSD; USDCAD; USDCHF; USDJPY

Step #2

Next, place the 10 & 20 EMA’s onto your charts.

Step #3

Now, look at each currency pair that has the USD as the main currency. Looking at each pair, you will be able to determine if the pair is in a bullish trend or a bearish trend using the EMA’s. If the USD is currently strong: you will have most pairs with USD as the second base currency, such as EURUSD in a bearish trend.

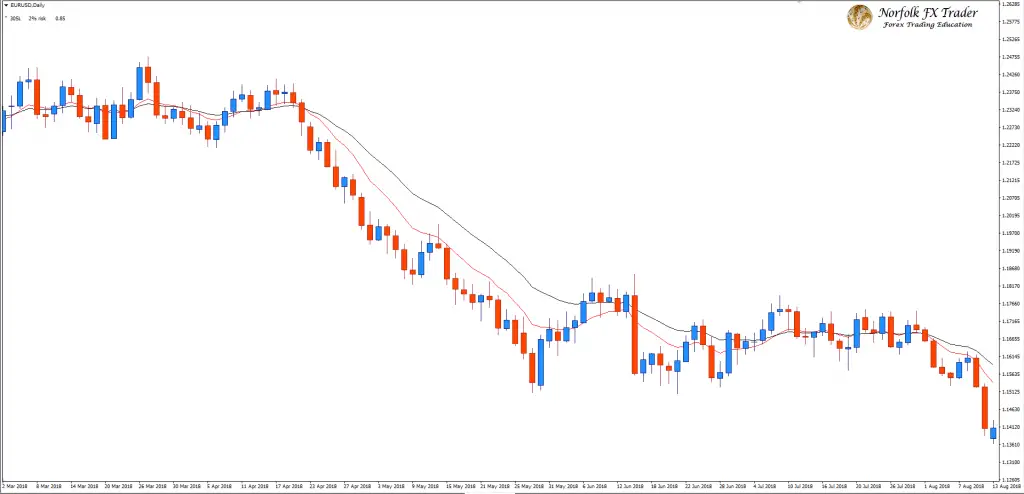

If the USD is weak, the EURUSD would then be a bullish trend using the EMA’s. Lets take a look at an example of the EURUSD and the GBPUSD at identical periods.

Looking at the chart examples above.

You will see how similar both look during this same period, showing the strength of USD. Now, doing the same process with all the other pairs, will give you a better understanding of the strength or weakness of the currency.

Powerful stuff, right?

So, make sure you do your homework correctly and you will always now know which currency is the strongest and which is the weakest.

Moving on…

Using moving averages to capture big trends

A moving average perfect Forex trading strategy

Putting everything together, you now will have a perfect Forex trading strategy that you will feel confident about and that is profitable. You’re going to use the EMA’s to identify the areas of value for you to trade. Then you will catch an entry with a already existing trend, and reap the rewards!

Sound good? Then lets get started:

Step #1

Time frame you will be using for the strategy is going to be of importance. I suggest the use of the Daily time frame as it will give you the very best setups using this strategy. If you are using a Daily time frame I also suggest the use of a broker that offers you New York close candles 5 pm EST.

If you don’t currently have a broker using this Daily close I suggest you check out my best broker of choice here.

Step #2

How much are you going to risk on each trade you take?

I suggest that the max amount you risk per trade is 1-2%. Anything higher is not going to be using good risk management.

Step #3

Here’s the exact moving average perfect Forex trading strategy you can use…

- If the 100 EMA is pointing downwards and price is below it, this is a down trend condition. (opposite is true for the up trend)

- If a downtrend, then using the 10 & 20 EMA’s, wait for price to find value at the EMA’s with a test of dynamic resistance.

- Look for a valid price action signal of the area of value.

- Target the same amount of pips as the previous market swing.

If you are unsure how to read swings in the markets, then I suggest you check out my trading lesson I wrote on a Forex swing trading strategy after this lesson.

Lets take a look at a few examples:

Important considerations to perhaps ask yourself:

- Do you take the first or second bounce of the area of value after the cross over in trend direction. (As shown on both trades)

- How much are you going to risk on each trade

- Which time frame are you going to trade this perfect Forex trading strategy on?

- Which pairs are you going to trade

I have no hard set of rules for this strategy.

However, make the strategy your own and make it fit your own trading style and personality. Or perhaps you want that extra help, and are in need of a trading system already tested and one that uses only raw price on the charts. If so, then you can find out all about how to on my course page with how to trade naked by clicking here.

Final Words…

To recap what you have learnt in today’s lesson…

The Moving Average indicator helps you:

- Identify the path of least resistance

- Identify areas of value on your chart

- Better time your entries

- Pick the best markets to trade

- And capture big trends

Above all,

I hope this opens your eyes to how powerful it can be trading with the moving average as your wing man!