Are you interested in a what is Forex swing trading system, are you currently day trading with loss after loss? Have you always wanted to make money in trading.. to live the life of your dreams earning money from home – then I have great news for you. You’re in the right place!

A Forex swing trading system is a style of trading whereby a trader attempts to profit from the price swings in the market. These positions are usually open from a few days to a few weeks at a time. Swing trading is a fundamental type of short-term market speculation where positions are held for longer than a single day.

Looking for a simple yet profitable trading style? Look no further than a Forex swing trading system. Learn swing trading, and see how it can turn your trading around.

Plus, get my 6 step-by-step process I use to profit with swing trading.

Exclusive Bonus: Download My Ultimate Forex swing trading blueprint guide…

That will show you the exact same 6 steps I use when trading the Forex markets.

To get the Forex swing trading blueprint guide just click here now.

If you’re totally new and want to learn swing trading in more detail, then start with my recent article I wrote on an introduction to swing trading by clicking here.

I am about to show you the most amazing Forex swing trading system that you can use to pull consistent profits out of the Forex markets.

But first,

Let me tell you one secret which all legendary traders know, and 99% of traders have no clue off! Do you know why these legendary traders make millions, while you struggle to keep your head afloat?

Because They Are NOT Day-Trading!

That’s right, they don’t day-trade, and they don’t even scalp the markets why should they?

Day trading only leads to:

- Bigger Spreads and Commissions

- Lower Win Rate

- Lower Profits

The only one who finds day-trading profitable.. is your Forex Broker!

Learn What Is Swing Trading System, As It’s MUCH More Profitable!

The top 95% traders of the world don’t bother with trading on 5-minute charts or even 30-minutes.. because they know that all you’ll find there is plain noise.

Even the trends in these lower charts are short lived and not worth following. Why would you look to try and gain a 20 pip profit, to just lose half on your brokers spread and commissions!

If you use a Forex swing trading system, you turn the tables to your advantage!

What Swing trading means for you:

- Bigger trends and bigger profits!

- Fewer trades, less broker charges

- A higher win rate, providing greater accuracy!

- Less chart time, more freedom!

- Much less stressful

But first, what you will learn today with my Forex swing trading system-

- What is Forex swing trading

- Using a daily chart to find swings

- The use of support and resistance

- Spotting the market phase

- How to find that price action signal

- Adding an edge to your swing trading system

- Moving down to the 4 hr time frame

What is Forex swing trading?

Forex Swing trading is a term used called support and resistance trading. When a resistance is broken, a trader would wait for price to return to the broken resistance to act as a support.

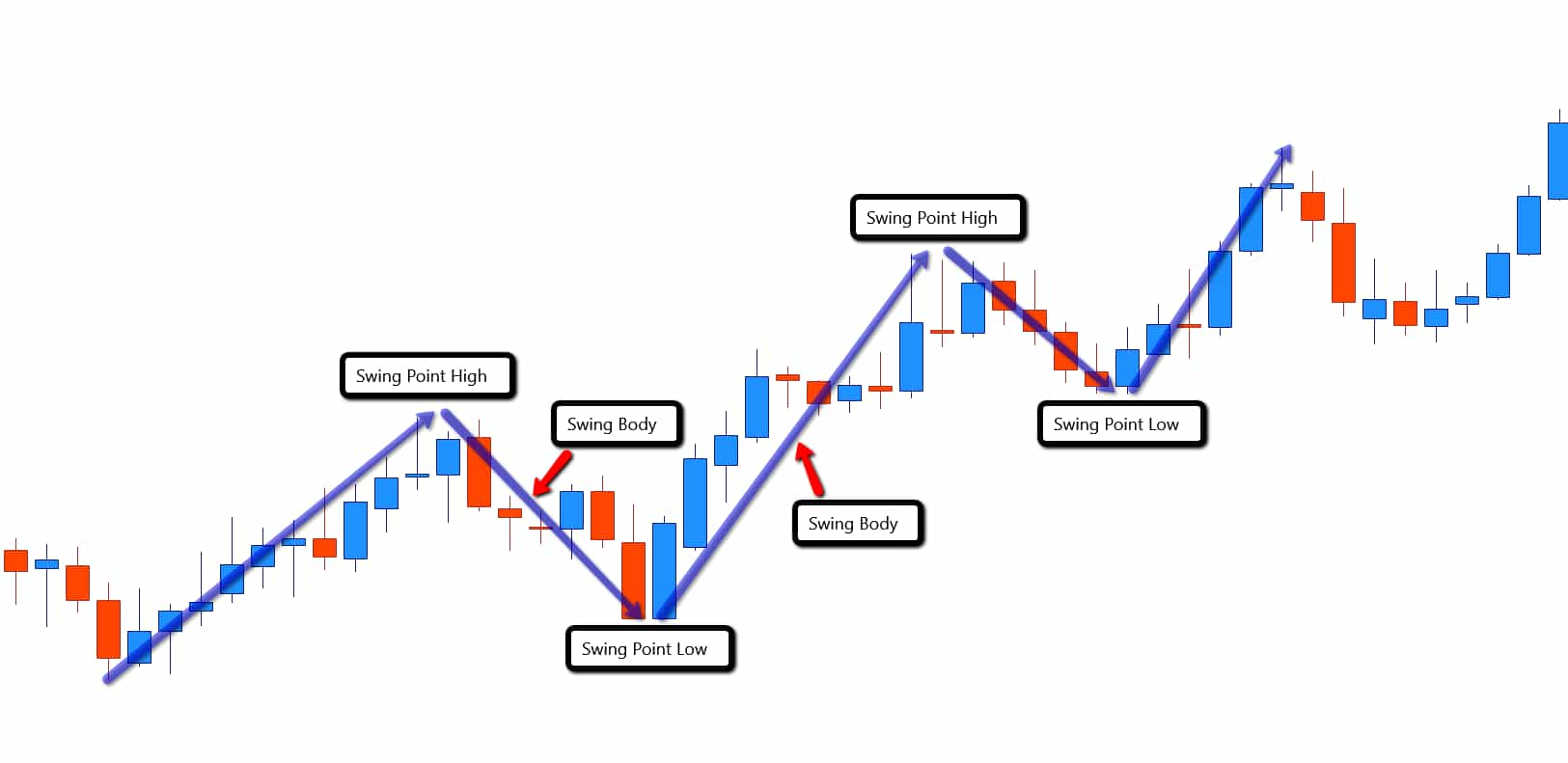

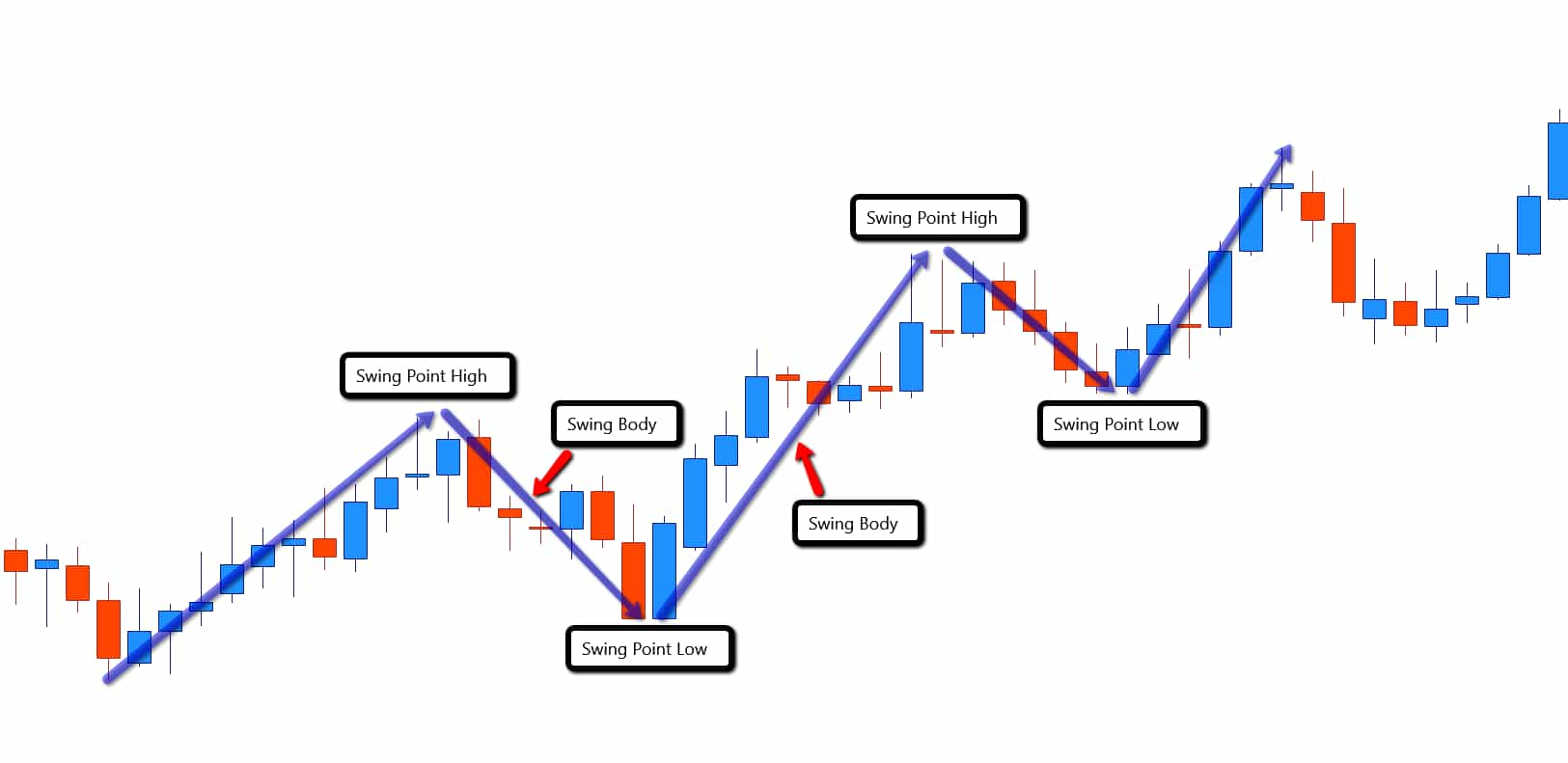

Lets look at what these swings would look like on a price chart below.

However it is at this point on a chart a trader will then look for trading opportunities. To form any trade signals coming off the newly created support.

Therefore, giving a trader an edge within the market before the actual trade occurs. As the name implies, Forex swing trading is an attempt to profit from the swings in the market.

Start today with the Forex trading made easy course which utilises the Forex swing trading system by clicking here.

As traders it is our requirement to find these swing formations and profit from them in the market. Catching a swing from the very peak or bottom of the move is not necessary.

Time to wait:

In fact trying to catch these swings from the very top or bottom. Will most probably lead to a trader having more losses.

What should I do?

A better approach would be for a trader to wait for a valid price action signal. To form at a swing low or high to confirm price is more likely to move into the swing direction.

Using the daily time frame to find swing Highs & Lows

With using a swing trading strategy, I have found the best time frame of choice is the Daily charts. It’s also possible to use a 4 hr time frame, but I have found the Daily works best.

I suggest for you to start out using the Daily time frame then once profitable to then move down to the 4 hr charts.

It’s also important…

To point out that using a New York daily candle close is just as important. This close will come at 5pm EST.

As a general rule the higher the time frame you trade especially with a Forex swing trading system. The better the price action signals you will have to trade, giving you a better result of a longer time.

The use of support & resistance levels with a Forex swing trading strategy

When applying a swing trading strategy approach to your trading one of the most important parts to your success, will be the proper use of support and resistance. If you haven’t done so yet, you can read more on the difference between support and resistance trading on another article I wrote by clicking here.

With using support and resistance, there are two types you may use. The first being horizontal levels of support or resistance. These being the basic levels you will need on a chart to trade.

To provide…a great foundation not only when searching for swings but also targets. The second being trend lines, which are classed as more diagonal levels of support and resistance.

Trend lines are a great way to spot swing trading entries with a trend. Plus will give a trader a heads up for spotting early reversals within the market.

Spotting the phase of the market With A Forex Swing Trading System

Now if you have followed what I have suggested above, you should have a nice clean chart open on the Daily time frame. With some major levels of support and resistance plotted.

How to find the phase?

Your next step will be to spot the market phase, to find if the pair you are looking to trade is in the correct phase for a swing trading strategy.

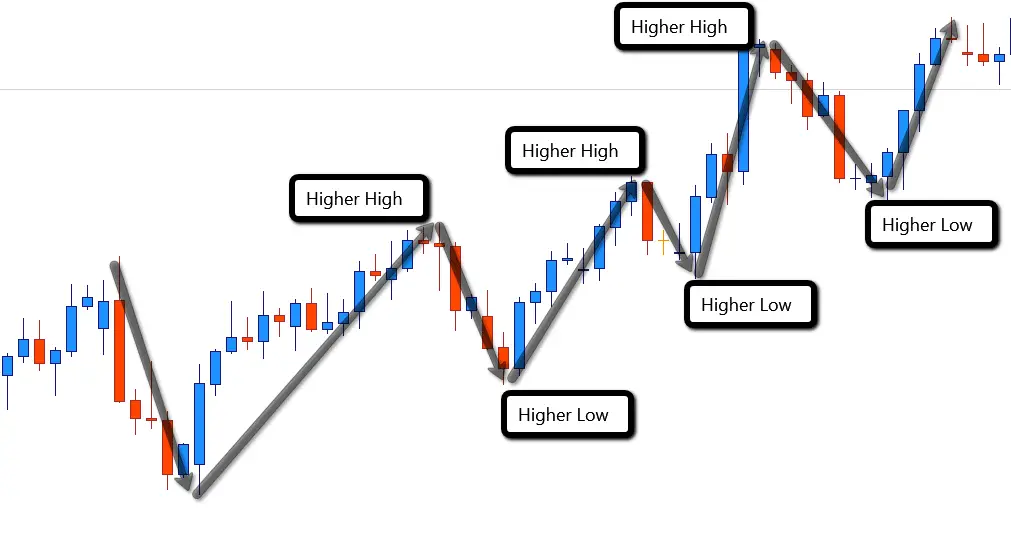

- Uptrend market phase (higher highs and higher lows)

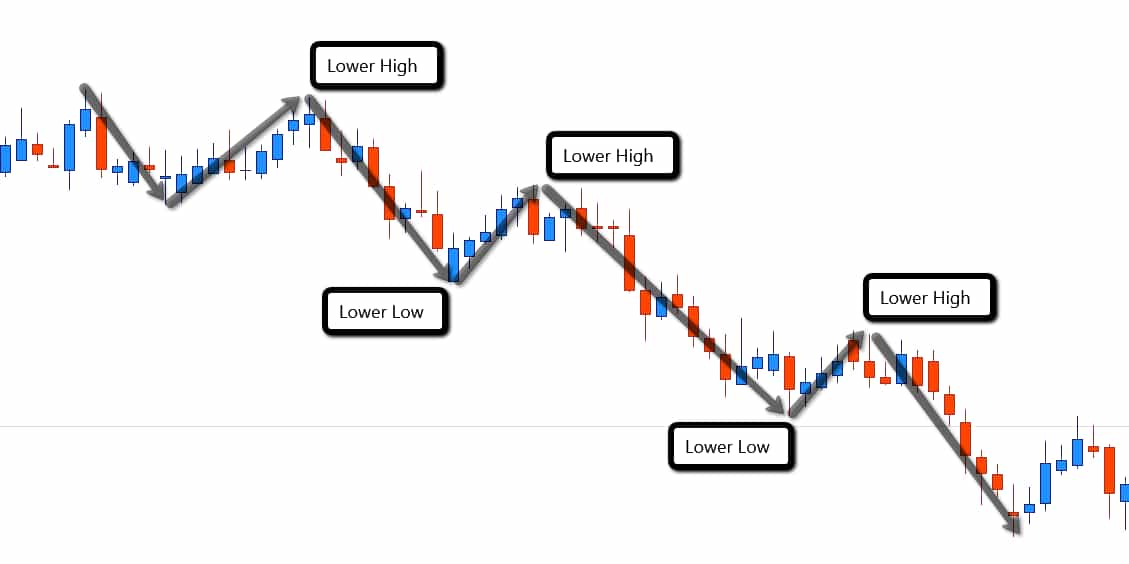

- Downtrend market phase (lower highs and lower lows)

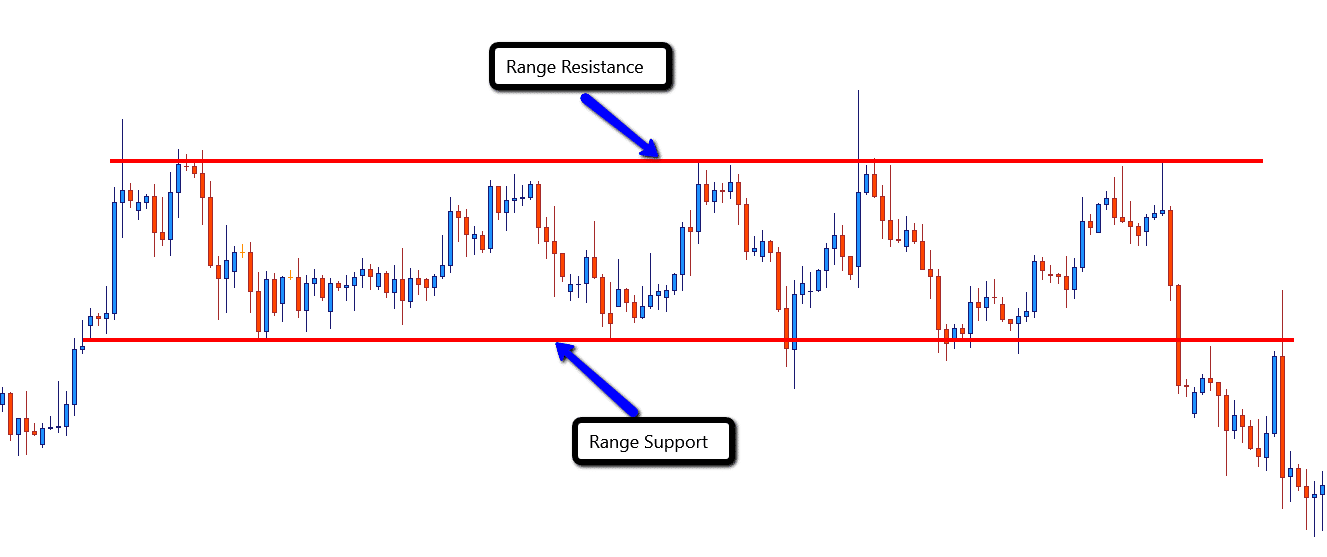

- Sideways market phase (range bound market)

A market phase within an uptrend will be making higher highs and lows.

Notice on the chart above how each swing is higher than the next. Here as a trader you would want to be a buyer with the bullish momentum in the market. The opposite is true for a down trend market phase. With each swing being lower than the next, with lower lows and lower highs.

Here you would want to be only a seller with the momentum to the downside. With the market creating the lower highs and lower lows. The final phase would be the sideways market, where price is trapped within two levels of a support and a resistance.

Even though price is in a sideways market in the phase on the above chart. This doesn’t mean you cannot take price action signals from the outer range.

Finding a price action signal to trade?

Forex Swing Trading System Guide Recap..

The next step to using a Forex swing trading system, will be to find a suitable entry. Lets now recap what you have learnt so far with getting to this stage.

- You should now be looking for a swing to form off the daily time frame.

- The major levels of support and resistance should now be plotted that you want to see a price action signal to form at.

- From seeing what phase the market is in, you will know if you are looking to buy, sell or trading a range.

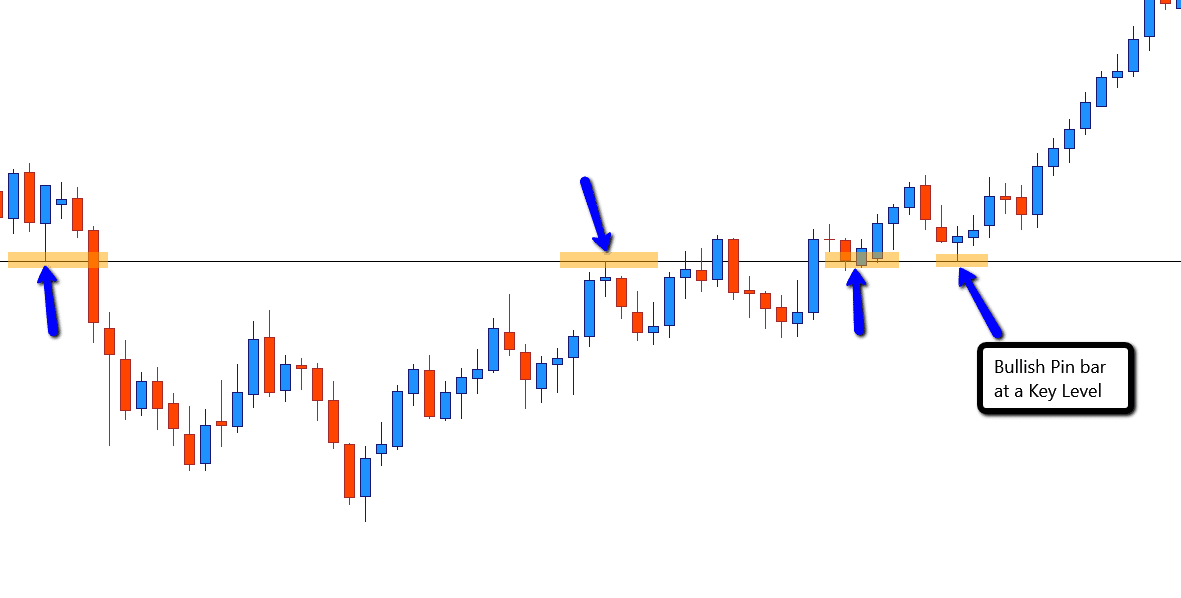

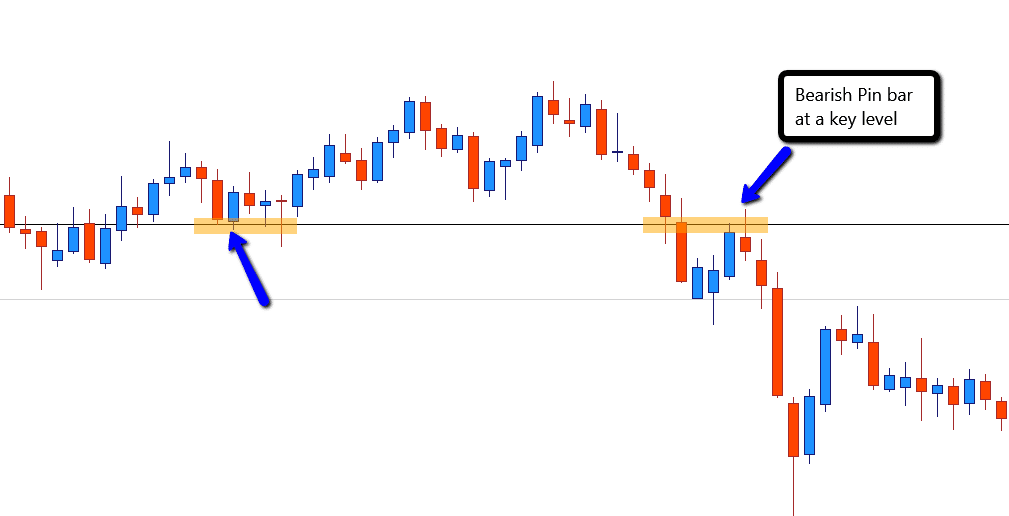

Now you are ready to find that price action signal for your trade entry. One of my preferred signals with a swing trading strategy is the Pin bar. If you haven’t already read through the basics of Forex trading.

Then you can learn more on the basic candlestick patterns to use with a Forex swing trading system on a article I wrote by clicking here.

Lets now take a look at what a good looking pin bar setup will look like at a swing low in an uptrend.

Look to profit from price action:

As a trader your goal here is to find these price action setups to catch the next swing trade long. The idea of this trade would be looking to profit from the bullish momentum.

Now remember!

When you look for a trade setup using a pin bar as within this example. It’s best not to just search for the setup through your charts and forget the rest.

What should I do instead?

You must find the setup at a location where a swing is expected to occur coming off a solid key level. Many new traders will take this information and just start to search for a pin bar on their charts to trade. Trading like this will most likely bring a trader more losses than necessarily.

Plus, always use the steps to find a valid trade setup and never go looking just for any pin bar to trade.

Adding an edge to a Forex swing trading system!

I will now investigate how adding an edge to a Forex swing trading system, can greatly place the odds into your favour with catching a winning trade. But first, if it’s an edge you’re after then there’s no better edge to your trading, with learning how to trade naked!

I mean being able to read raw price on the chart. If this is something that interests you, then check out how you can learn to trade with nothing but price on the chart by clicking here.

Now, back to the edge you can apply with using the Forex swing trading system, with the use of some ema’s to your chart. Which can put the odds into your favour of catching a winning trade.

Why is this?

With using price action and candlesticks, you can also use what is called a EMA (exponential moving average) on a chart. This can give a trader a quick glance of a current pairs trend, therefore would in due course also cut a traders chart time.

That’s great!

For instance some of the most commonly used EMA’s on a price chart are a 8,10,14 and 20 EMA’s. Two of which would be used in conjunction of each other to determine a pairs trend at a glance. Lets take a look at what this will look like on a price chart. With the examples I will be using today, I have the 8 and 14 ema’s on the chart.

How the moving average looks on a chart:

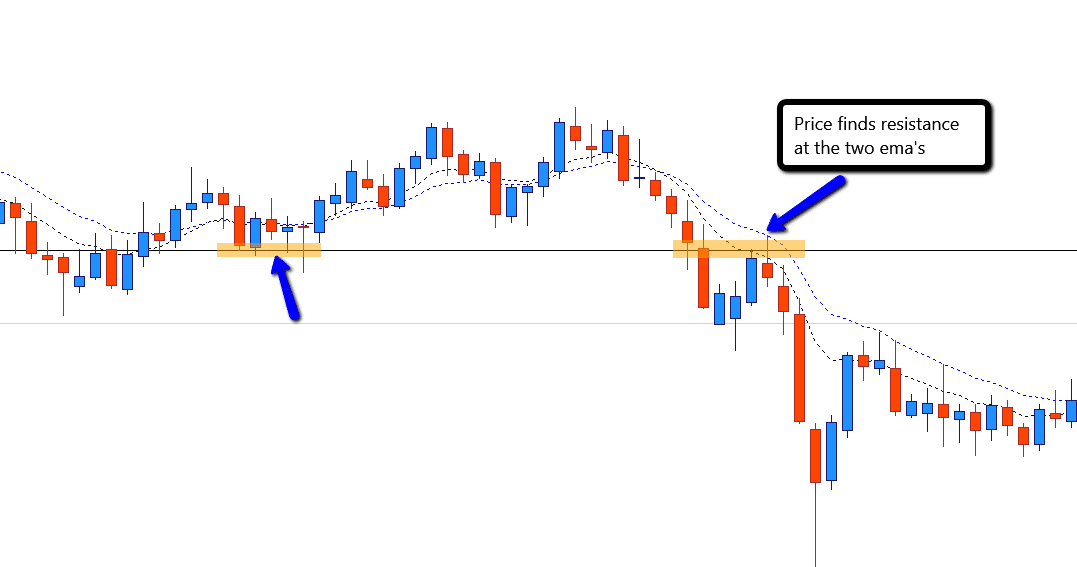

Lets now look at two charts, one with just price on a chart using the standard support and resistance with a swing trading strategy.

The very same chart with adding two EMA’s to show a pairs trend at a glance.

In conclusion…

Both charts show the same outcome with trading the bearish pin bar of a swing high. Plus coming off a broken support acting as a resistance. Only difference between the two charts above will be the two EMA’s on the second chart, which shows a strong downtrend at a glance.

How will this help me?

This will let a trader with ease check through the charts checking if there is a strong trend in place. These are the perfect risk to reward trades as a trader you should always be watching out for. As a swing trader these types of setups will be exactly what puts you into the top 5% of successful retail traders.

The Moving Average Time saving

Which ever path one would take with a Forex swing trading system, both outcomes would be the same with taking a trade.

Using the EMA’S will give a trader an edge with spotting if there is a strong trend in the market. With at a glance knowing ahead of time if the pair is worth investigating further. It is a traders preference which a trader feels most comfortable with trading the strategy.

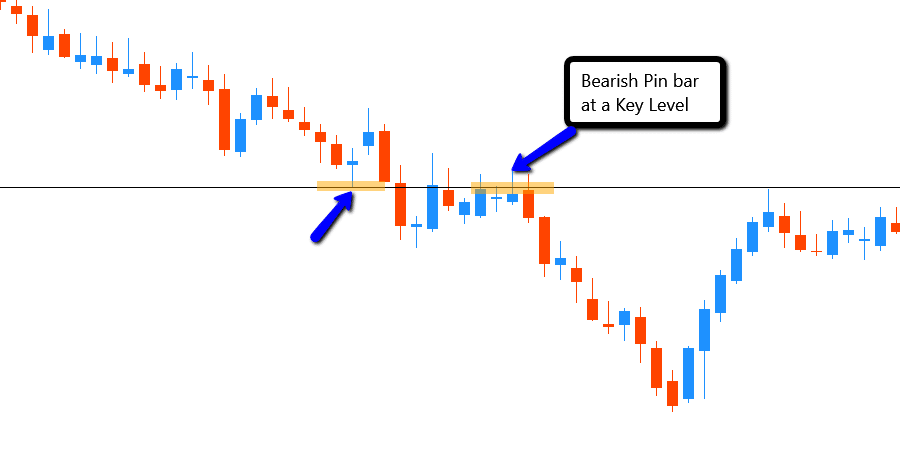

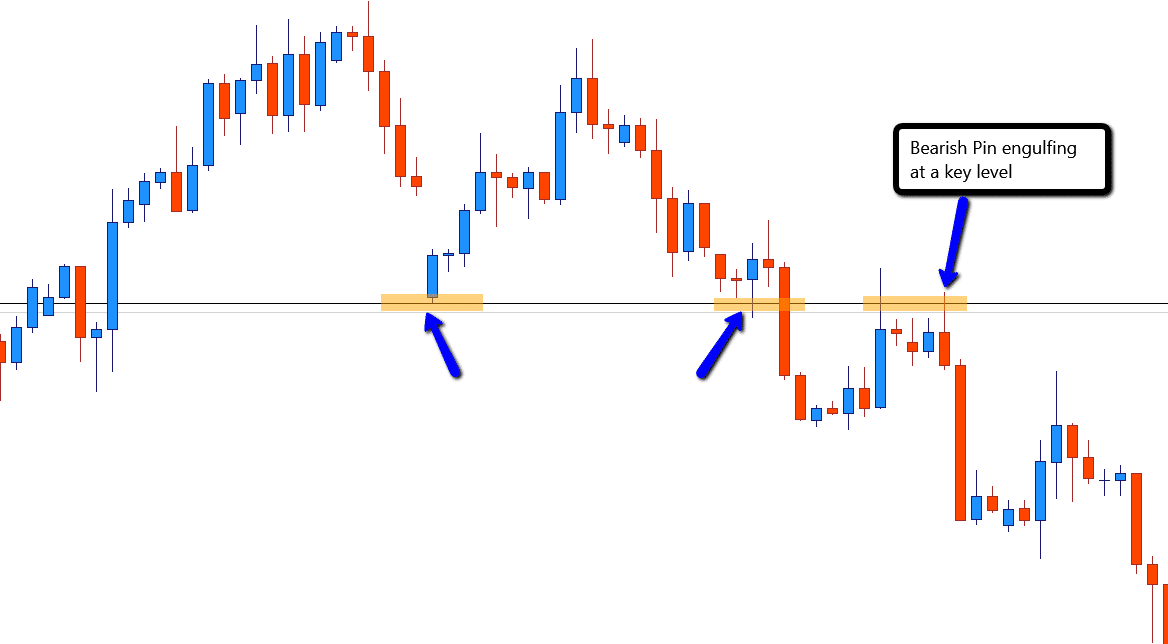

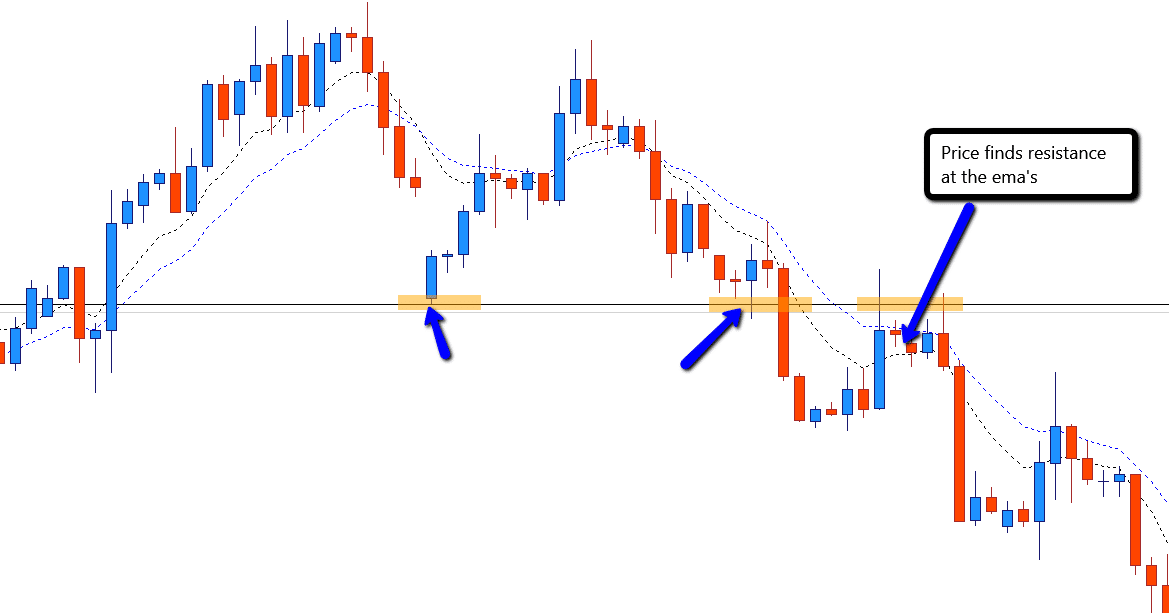

Some more charts below to show this swing trading strategy, which is best traded on a Daily time frame.

Once again the trade came of a broken support, then acted as a resistance from below with a inside bearish candle or a pin bar. The two EMA’s again gave a good quick glance of the nice downtrend in play.

With also giving a trader an opportunity was most likely to occur at this dynamic area. Trading on the higher time frames, will give a trader not only more freedom with chart time. But also trading more in line as the Banks trade.

With trading, their is always going to be a side that wins and a side that must lose. For retail traders their worst enemy is going to be themselves with trading discipline and psychology.

But to make matters even worse for a retail trader, you will have to compete against the large Banks with trading.

This is why a Forex swing trading strategy is the key to traders success.

Moving down to the 4 hr time frame

All of the above charts have demonstrated using a Daily time frame to use a swing trading system. A 4 hr time frame can also be used with a Forex swing trading system, but only once you have mastered the daily time frame.

Can you show me?

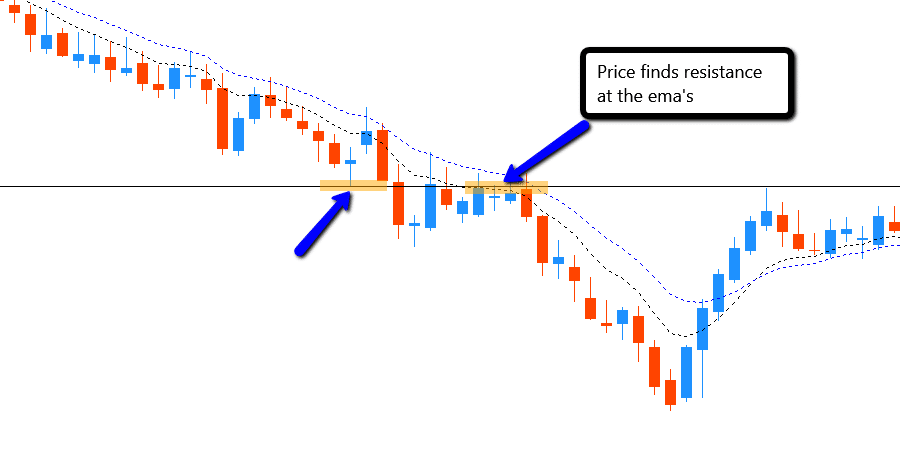

I will show you how using a lower time frame can still be used with a Forex swing trading system and ema’s. See the chart below where price is breaking a support, afterwards testing from below as a resistance.

Giving a good spot for a swing trade setup with the correct price action signal. On this occasion there was a nice pin engulfing candle which was formed and the trade fell off.

Pay attention!

These types of trades will be exactly what a trader must watch out for. Catching these setups are the profits to a successful swing trading strategy. After the entry this trade fell of nicely, in line with the overall trend.

Above all…

The EMA’s once again demonstrated at a glance a strong downtrend was in play. Without the correct training a trader would not have probably spotted any of the trades demonstrated.

A good understanding of support and resistance, along with candlesticks analysis is required. You can find more on these basics techniques by checking out the Basics of Forex trading page here.

Final thoughts:

Forex swing trading system is one of the more popular trading styles around and for a good reason. It allows for a trader to have a less stressful trading environment without forgoing their profits.

It’s ideal for someone who works full time and does not have the time to watch the charts all day. Not to mention when trading a swing trading approach on the daily time frame will give a trader more reliable trade setups.

In my opinion when you learn swing trading, the daily time frame gives better signals, just make sure you use the correct charting daily close with the New York 5pm EST.

It is very important that as a Forex trader you learn the basics to trading before you proceed with any further advanced training. With understanding candlesticks and support and resistance will give you an added edge within the markets.

Now it’s all down to you, try it out and see what you feel about using a Forex swing trading strategy.