Are you looking for an introduction to swing trading, to learn exactly what swing trading is all about. But just don’t know where to start, then you’re in the right place?

So what is swing trading?

Swing trading is described as a type of fundamental position trading, where trades can be held for weeks at a time. Swing trading can also be with the shorter term trends in the market, known as a swing trader. Learning the swing trading basics, such as how to read the market dynamics. With seeing when a price chart is trending or in choppy market conditions.

Will be crucial to a swing traders success, and it will also show you which markets to trade using a swing trading system. There are many types of swing trading strategies, but find out which one is the best to use as a beginner trader. Plus… don’t miss the pros and cons at the end of this guide!

Introduction to swing trading

For you to learn Swing Trading Basics, is going to be the top trading education of your trading, that you can implement in your trading arsenal.

Perhaps you are new to Forex trading or you have been Day trading only. And you know nothing about swing trading.

In this introduction to swing trading, you will have a much broader view of exactly what to expect with using a swing trading system. In fact, you can pop over now and read another one of my articles all about using a Forex swing trading system by clicking here.

Swing Trading Basics

Learning the swing trading basics is the first step to understanding how the markets move in a swinging pattern. These patterns form when the markets are in fact trending.

When a market is trending price puts in higher highs and higher lows in an uptrend, and the opposite for a downtrend. The momentum thrust in the main direction is called an impulse move. With an expected retrace in price against the overall trend would be called a corrective move.

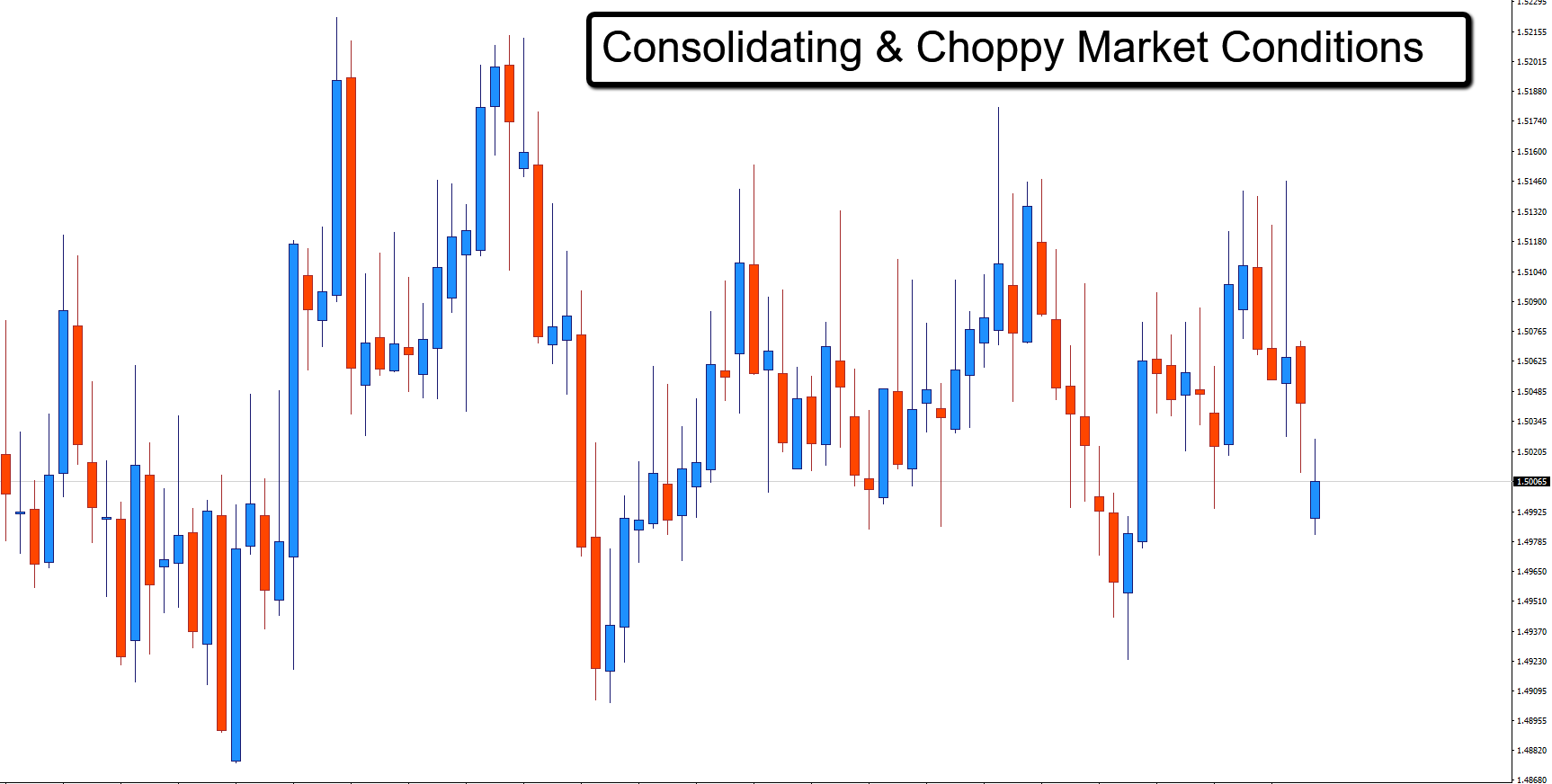

One key point to make, is that you are not trading when the markets are not in fact trending and to avoid the market chop. You can find out in more detail how to avoid these choppy markets from an article I’ve written by clicking here.

So you can see how important it is to learn the swing trading basics, before attempting to even start looking into any swing trading strategies.

How to learn swing trading?

Now you are more familiar with what swing trading is, and how to avoid choppy markets. Your next step is to learn swing trading and what benefits it can give you as a trader.

One of the top benefits using a swing trading approach, is that it typically takes only a few minutes each day to check your charts. Taking away those long hours of starring at the charts, like with a day trading approach.

Plus… with swing trading you will have more time when it comes to actually placing your trades, then if you was scalping the markets. You can read more on this subject, with the different types of trading you could potentially use on an article I wrote by clicking here.

Swing Trading Strategies

Swing trading strategies are basically a type of trading that sits in the middle of the continuum of day trading and the more known trend trading. Where a day trader will take trades and only hold these trades from seconds, to a few hours at a time, and they will never hold their trades any longer.

Where, when using swing trading strategies as trend traders, you will examine the charts for a longer term approach. Using fundamental analysis in the markets to make decisions on your trades. Which can be held from weeks to even months at a time, and more known as Position Trading.

But…as a swing trader you will also target trends, with the shorter term trends in the market. Holding these trades from a week to several weeks at a time, being the middle of the continuum.

Being successful as a swing trader, will require many considerations before taking a trade. With the first key consideration being which is going to be the right market to trade.

Which markets to trade with swing trading strategy?

When it comes to trading the right markets with using a swing trading strategy approach. You will need to find a short term trending market.

An introduction to swing trading solution-

The simple solution to this, will be to observe price on the chart. Price can be in one of three market conditions, with a bull market, a bear market or a range bound market, (meaning no side is in total control.)

As a swing trader, the range bound market will be the market to stay clear off. As when the market is consolidating is going to be the times using a swing trading approach will create losing trades.

So.. using this guide for an introduction to swing trading, you will need to first find either a bull or bear market to trade. These markets are going to be the ideal market conditions to start looking for swing trade setups.

After a momentum move in the direction of the controlling market side, as you learnt above. Will be the time to look for the retracement back to the ideal location to find a valid swing trading entry.

Spotting these types of setups to take swing trades will come with experience. The number one factor I see many beginner traders make is letting their emotions controlling their decisions in the market. Mainly this can come from over trading. Risks involved with swing trading are not going to be so volatile as day trading.

But… without the correct money management and a solid working plan in place you can soon blow your trading account.

If you struggle with your emotions in trading, then check out one of my latest articles I wrote all about how to control emotions with your trading by clicking here.

This brings me to perhaps the next question you might ask, which is swing trading profitable?

Is Swing Trading Profitable?

Just as any type of trading, it is only going to be as profitable as the trading education you receive on the subject. To a degree, swing trading is going to more profitable than day trading. Purely, from the fact of the consistency of swing trading compared to day trading and scalping the markets.

To a degree, using a swing trading strategy to trade with, will generate you more long term profits. Making this type of trading more desirable to traders who perhaps have a full time job.

Another large factor with, is swing trading profitable will be the risk management used with your trading. To make sure you fully understand the use of controlled risk in your trading. You should check out this trading article I wrote all about using correct risk management, plus a free risk calculator to use in your trading.

Other ways to make swing trading more profitable, can be to add an aided edge to assist with finding and trading the swings. One way to do this, is to add the use of moving averages.

The Use Of Moving Averages With Swing Trading

Some traders may find it beneficial with the use of moving averages with swing trading. These can comprise of the exponential moving average (EMA) or the Simple moving average (SMA) which can be found in further detail at Wikipedia.

Using moving averages

There are many ways a trader could use the moving average to assist with trading, when using a swing trading system, which you can read more on another article I wrote by clicking here.

Why does this matter?

With this guide on an introduction to swing trading, I will now share with you some ideas with how you could use moving averages in your trading. One of the typical known methods of using the moving average, normally using the EMA as a cross over strategy.

This would evolve a trader to plot two EMA’s onto the chart and wait for the lines to cross over for an entry and an exit with the next swing.

For an example:

Using a 5 and 10 ema, once the 5 crossed from below to the upside of the 10 ema this would show a bull market is about to continue. With the opposite showing a bear market. A trader may use this crossover to time their entry and of course their exit on the swing.

In another trading lesson I share with you…how I use moving averages to create winning trades after winning trades. Unlike the typical EMA cross over signal (which can create many losses in a choppy market)

This method of applying moving averages when you learn swing trading, is going to give you the trader a visual guide of what is called dynamic support and resistance.

To get the moving average Forex trading strategy guide [2019] that I wrote recently just click here.

Profit targets with swing trading

An introduction to swing trading with your profit targets. When looking for the ideal location to close out for a profit when using a Forex swing trading system.

A trader will look to target a measured objective, this move is usually applied to a channel that is used in the direction of the dominate trend.

For an example;

If in a bullish market, a trader will have drawn a bullish ascending channel on their charts. To read more on basic trading patterns in the market check out another trading article I recently wrote all about basics of Forex trading by clicking here.

The measured objective target for the swing trade will be at the top of the ascending channel. Plus… the use of Fibonacci extension levels will add further accuracy to the targets. Other factors may need to be taken into account for the actual profit target, depending on the strength of the trend that is in play.

Why does this matter?

If the market trend is not as strong, then the objected target may not then be used. Instead targeting previous price highs or lows in the market may create a higher percentage chance of being achieved.

To understand the use of an measured objective you can learn more on another trading lesson I recently wrote all about Forex market trading mistakes. That can cause you to lose profits, plus with my fixes to the problem by clicking here.

Pros and cons to a simple swing trading strategy

Lets now examine the pros and cons with using a simple swing trading strategy.

Pros to a simple swing trading strategy

- The Forex markets will never go in the same direction all the time, with using what you learnt with swing trading basics. This allows you to take advantage of this. Therefore increasing the potential returns by being able to trade the rallies and if you wish the pullbacks.

- Unlike a Day trading strategy, a simple swing trading strategy is not a full-time pursuit. Where, day trading you must be on top of all your trades every minute. In swing trading you get to relax a little more as you’ve set your trade to run over the course of several days, or even weeks. Allowing you to swing trade while carrying on with a full-time job.

- Losing trades can be limited, when using the appropriate technical signals, allowing you to know when a trade isn’t working more quickly and limiting the losses.

- You’re able to plan the trade beforehand, unlike day trading when each trade taken is on a whim than having the time to do technical analysis as with a swing trading system.

Cons to a simple swing trading strategy

- Volatile markets are not necessarily the best conditions in which to practise a simple swing trading strategy. Because if you get the signals wrong, all previous profit can be wiped out in a matter of seconds

- Similarly, you can’t always trust your instinct following the trends. While markets often display lengthy periods of range bound markets, picking the incorrect entry points can also lead to unnecessary losses.

- Understanding technical analysis is of utter importance, without the proper use of technical analysis it can lead once again to unnecessary losses. Just trading with the use of fractals isn’t enough, you will need to know how the markets move with the use of market structure, and that means study.

- It can be stressful when you learn swing trading, perhaps not as nervy as day trading, but you’ve still got to have a cool and confident mindset that’s not prone to being side tracked easily.

Final Words

Now you’ve gone through the introduction to swing trading, you will know what’s involved to being a successful trader. Knowing which markets are the best ones to using swing trading basics, and understanding that you need to keep your emotions in tack to succeed.

Adding the moving averages to a swing trading system, can very well improve your win ratio compared to just trading with the swings. The perfect moving average strategy can be found on another article clicking here.

The final key to success with swing trading, is knowing where to set your profit targets. Best way for you to learn this approach is by checking out another trading lesson on a simple swing trading strategy clicking here.

For more trading articles click here.