Have you seen other traders using market structure with their entries in trading, and you want to know what is market structure in Forex trading? If so, then you’re in the right place!

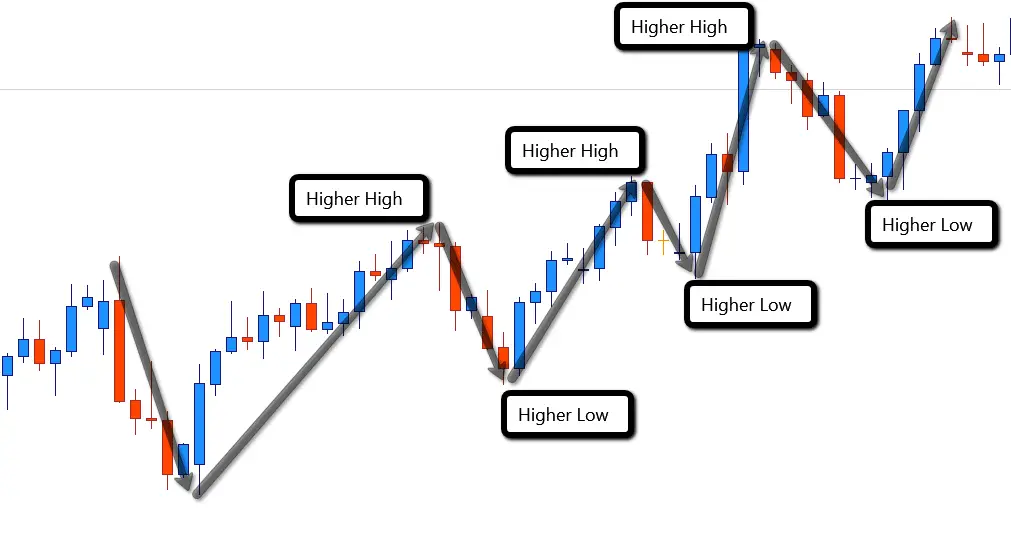

Market structure in Forex trading or price action, is a movement of price on a price chart. As price moves in a fractal nature this demonstrates a price pattern of a series of higher highs and higher lows creating an uptrend market structure. Or the opposite with lower highs and lower lows being a down trending market structure.

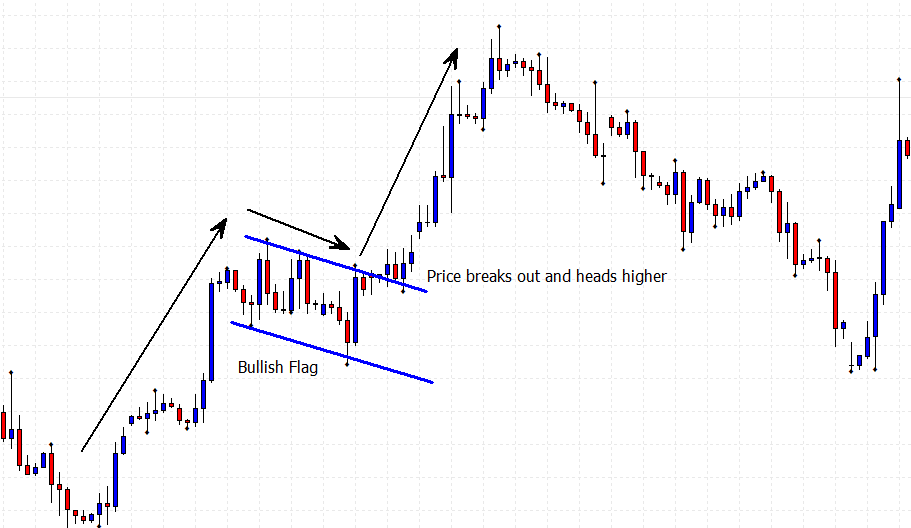

Market structure in Forex trading can also be a price pattern, which relates to patterns such as the bullish and bearish flag pattern.

While indicators definitely belong, really little trumps with the use of market structure.

As you’ll see shown in the following post, developing trading concepts off standard market structure can be remarkably simple, and more notably, rewarding!

Price Movement With Market Structure In Forex

When it comes to what is market structure in Forex trading. As much as we ‘d all enjoy to see price trade linearly, especially if one has a open position because instructions, it’s simply not how the marketplace functions.

While disregarding the essentials of day trading in any market conditions. As what is market structure in Forex trading, is being able to check out market structure areas on a price chart.

Market structure is the most essential tool you will ever get in Forex trading, and being able to read it will open your eyes to a brand-new world of monetary markets.

What is Market Structure In Forex Trading?

As the ocean falls and increases along a coastline, price action will move in ups and downs in a comparable way. This can be observed on any time-frame from as low as the 1 minute chart right approximately the month-to-month scale.

Market structure by it’s meaning, is the most basic kind of price motion in the market, and is being able to read it that will give a trader an edge in the markets.

Market structure in Forex trading is a pattern following tool that traders check out and follow based on how price relocates through a price chart.

Comprehending the marketplace market structure implies comprehending the course of least resistance in a more extensive method. Which is advantageous for both discretionary and system traders.

This will permit traders to filter out setups showcasing less prospective to focus and prosper on those more potential ones.

To learn more on what is market structure in Forex trading, I suggest watching this first video lesson on market structure that I created recently.

How To Determine Market Structure In Forex

If you enjoyed the above video, and want to take your trading to the next level with understanding how I use market structure in Forex trading.

To locate and find winning trades, then you won’t want to miss my latest released eBook! All on price action trading and market structure, to find out more click here now.

Different Kinds Of Market Structure In Forex?

With what is Market structure in Forex trading, you will find that market structure is an easy and a fundamental type of understanding, with how the markets move.

It’s simplified with simply 3 various kinds of market structure.

When a shift takes place based on the time-frame you’ll see this is essential to effective trading, the market pattern in 3 various instructions at any offered time and understanding.

There are numerous found and certainly undiscovered patterns for traders to utilise and discover, however understand patterns that do not have internal reasoning. Anticipating a bullish day on the GBP/USD simply due to the fact that your preferred football club won a match on Sunday is most likely a random pattern.

Price Patterns With Market Structure:

Understanding the marketplace Psychology and the Patterns that are recurring price motions that supply more details to the trader. They offer more details about prospective turnarounds, pattern corrections, pattern extensions, varieties, and breaks out of varieties.

Here is a list of a few of helpful and evaluated patterns:

- Chart patterns

- Candlestick patterns

- Divergence patterns

- Break, pullback, and extension patterns

- Wave patterns

If you wish to learn more on the different types of price patterns you can successfully trade in the markets click here to go to one of my other trading lessons.

Up and Downtrend:

- Defining the Price Direction

- The idea of pattern shows the general instructions of the chart. Is the rate going up, down, or sideways

The Path of Least Resistance:

Utilising the marketplace Structure, with what is market structure in Forex trading with where price streams naturally from one level to another as it selects the course of least resistance.

At each area, the cost might continue with its momentum or regard the support or resistance level.

This suggests that:

- If the momentum is weaker, the price will stop at (strong) support or resistance;

- If the momentum is more powerful, the price will break through support or resistance.

- Patterns offer more details about the fight and balance in between S&R and momentum.

- An extension chart pattern like a bull flag might show that the S&R level may break when the momentum chooses up speed once again.

The 3 kinds of market structure in Forex are:

The chart is thought about to be trending when the price is going up (bullish) or down (bearish), whereas sideways motion is referred to as a variety, or non-trending chart.

A pattern is an essential element of checking out the chart as it provides traders the capability to comprehend which instructions is more powerful due to the fact that the pattern is most likely to continue unless there shows up turnaround patterns.

Bull Pattern;

The bull pattern is portrayed by greater highs and greater lows. The pattern will continue in that direction until a lower low is printed by the possession price. When price eventually stops printing greater highs, the pattern starts to reveal indications of a weak point.

Bull flag chart patterns suggest that the price is much more, and most likely to continue with the pattern, specifically, if the price moves to break the flag resistance with strong candlesticks (suggesting that the bulls are holding control).

Sideways pattern;

With a sideways price pattern, these patterns form in a variety throughout this point of the market and is in debt consolidation. Markets can move in a duration of combination for a long time.

It’s best to stay out of these consolidating markets, and wait for the market to start moving into a new trading direction.

Bear Pattern;

The bear pattern is the price action of lower lows and lower highs. The bear pattern will continue to fall as long as lower highs continue to print, once a greater high enters into the market, the pattern will end.

Thus indicating that the pattern might be reversing as price starts to print greater lows or equivalent lows.

With what is market structure in Forex trading, the market patterns in one of the 3 instructions above and comprehending how to check out the extension of the pattern and of the failure of the pattern, all originates from having the ability to check out market structure in Forex!

3 various types of market structure in Forex

Market structure, and price patterns can be various depending on the time-frame picked to trade. If you are a day trader you might see a specific pattern on an everyday chart, than on an intra-day chart it might be entirely opposite.

A market that’s pencilling in a series of greater highs and greater lows (referred to as an uptrend) will usually bring in purchasers looking to join this trending motion, and appropriately so.

What occurs when a greater low is not able to sustain its benefit existence and drops lower, printing a lower low. This is when very often the turn in the market structure will happen.

HH– Higher high

HL– Higher low

LL– Lower low

LH– Lower high

Have a look at the everyday chart of the EURUSD listed below, the greater highs and greater lows are incredibly obvious.

This type of price structure is also referred to as swing trading, if you are looking for a great trading lesson for swing trading then you won’t want to miss this next post clicking here.

Let’s utilise an example, of a Daily chart and a 1-hr time frame (micro-structure view). While on the Daily view, there might be strong bullish bias showing higher highs and higher lows, on a 1-hr time-frame you could have a bearish bias as the micro structure shows a downward trend within the Daily retracement.

The micro-structure is really crucial since it determines essential levels of support and resistance in the market.

Utilising multi-time-frame analysis to determine the trade chances and the circulation of the market is extensively utilised and extremely efficient. So on the time frame you trade on, you will discover another market structure.

To discover more on using the combination of market structure in Forex trading and multiple time frames. You can watch this latest video I created to demonstrate how simple technique this is.

Just as using this approach to allow you to see the other market structures, with what is market structure in Forex trading. These multiple time-frames can also show a trader when a pair can appear very choppy on one time frame, but a good trend structure on a higher time.

See the example below of the GBPUSD pair with a 4-hr time frame and the 5 minute time frame. With how the 4-hr shows a bullish trend using market structure. Where the micro structure of the 5 minute time frame shows a sideways market.

Utilising standard structure can anticipate prospective pattern turnarounds? There is NO method that can determine a pattern turnaround 100% of the time though. This is difficult!

While we might effectively see a down trending market on the M1 time-frame, according to above, greater time-frames might (and really frequently do) pattern in the opposite direction. This is the fractal nature of the marketplace.

With that being stated, utilising the standard concepts revealed above one can properly identify where the buyers/sellers are acquiring strength. This might cause an ultimate pattern modification.

Market Structure Charts and examples in Forex

As discussed above, when utilising market structure to determine the motion of price on a chart, it depends upon the time frame utilised. And various market micro-structure and fine-tuned.

The pattern is plainly to the advantage and we’ve determined some strong levels for both support and resistance. Viewing for impulse relocation that develop brand-new lows for the bear pattern pull back.

You can see from the 4-hour levels holding well and validating the trend line structure. From here we recognise the level for the short extension based on the bear pattern. The previous broken bottom or the impulsive move that brought the price to a brand-new low.

Market Structure With Support and Resistance: Spotting Key Decision Zones

The very first crucial action with what is market structure in Forex trading is to comprehending the marketplace structure like a pro. Which is outlining essential Support and Resistance (S&R) on the chart.

The factor is uncomplicated: the price will typically rise, stop, or reverse at these S&R zones.

This tends to take place specifically when:

- There is confluence of levels at or near a price zone.

- The price is approaching an appreciated and current S&R level for the very first or perhaps 2nd time.

Traders require to be knowledgeable about the significant price zones to prevent trading into secret levels and possibly even be prepared to trade far from those levels (i.e., taking a long at support if greater amount of time remain in an uptrend).

Secret S&R levels can be really varied, and, eventually, it’s up to each trader to reveal the favoured tools. Including too numerous S&R levels, nevertheless, will mess the chart.

To learn the differences between support and resistance and why it matters check out this post clicking here.

Final Thoughts

When it comes to other markets, like the futures market, there are a lot of various tools to utilise. The basis of day trading or even swing trading the futures market is once again market structure.

Comprehending how one property moves based on price will open your eyes to an entire brand-new world.

The very first important action to comprehending the market structure like a pro is outlining essential Support and Resistance (S&R) on the chart.

The factor is uncomplicated: the price will frequently appreciate, stop, or reverse at these S&R zones. Including too numerous S&R levels, nevertheless, will mess the chart.

The rate streams naturally from one level to another as it picks the course of least resistance. At each area, the cost might continue with its momentum or regard the assistance or resistance level.

Market structure in Forex trading or price action is how lots of individuals take benefit of the markets. Day trading on Forex is not unusual and possible and once again, done with market structure.

Market structure by meaning is the most basic type of price motion in the market and is being able to read it.

Market Structure in various markets, Traders can utilise market structure to trade any market! Understand how to trade market structure and you can trade any market.

Simply like you will when trading or investing in stocks! Moral of the story, find out market structure to trade markets more effectively. Any market, any pairs at any time.

Mapping out your charts and basing trading concepts off market structure is an exceptionally arranged method to trading the marketplaces.

Provide it a shot! You might marvel how basic it actually can be.