One of the standard duplicating patterns is a fractal. Fractals are basic five-bar turnaround patterns.

Fractal markets hypothesis examines the day-to-day randomness of the marketplace through making use of technical analysis and candlestick charting.

In this trading lesson I will discuss what is the optimal strategy to look to use fractals in Forex trading, and how a trader would identify a valid fractal on a price chart?

Traders can use fractal indicators to determine the possible direction of price in the Forex market, and is designed to align a trader with the trend.

One way in which traders do this, is by looking for broken fractals. A fractal is considered broken when a fractal has been confirmed after the 5th candle has closed, and then price breaks through either the high or the low of the pattern.

Using fractals in Forex trading can be applied to a breakout, swing trading and trend following strategies.

Introduction About Fractals

When individuals hear the word “fractal,” they typically consider complicated mathematics. That is not what we are discussing here. Fractals likewise describe a repeating pattern that happens in the middle of bigger more disorderly price motions.

Fractals are made up of 5 or more bars. The guidelines for determining fractals are as follows:

- When there is a pattern with the greatest high in the middle and 2 lower highs on each side, a bearish turning point takes place.

- When there is a pattern with the least expensive low in the middle and 2 greater lows on each side, a bullish turning point takes place.

The fractals that I reveal listed later in this post are 2 examples of ideal patterns. Keep in mind that numerous other less best patterns can take place, however this standard pattern must stay undamaged for the fractal to be legitimate.

The apparent disadvantage here is that fractals are lagging indications. When the pattern takes place, the price is anticipated to increase following a bullish fractal, or fall following a bearish fractal.

How Do Fractals Work In Forex Trading?

Fractals are indicators on candlestick charts that identify reversal points in the market. Traders often use fractals to get an idea about the direction in which the price will develop. A fractal will form when a particular price pattern happens on a chart.

Many charting platforms now offer fractals as a trading indication, (like MT4 & MT5 platform). Use the indication to the chart, and the software application will highlight all the patterns.

Fractals are best utilised in combination with other signs or types of analysis. A typical verification indication utilised with fractals is the the current market trend.

If you’re utilising fractals in a general uptrend, look for the down fractal arrows (if you’re utilising a fractal indication supplied in many charting platforms). If looking for bearish fractals to trade in a bigger drop, look for up fractal arrows.

Often changing to a longer amount of time will lower the number fractal signals, enabling a cleaner seek to the chart, making it simpler to find trading chances.

Using fractals in this way can help develop your trading skills with picking great performing trades when aligned with the trend direction. More on how you can personally apply this with the trend later on in this trading lesson.

Another method is to utilise fractals with Fibonacci retracement levels.

By integrating the 2, it will narrow down the possibilities, because a Fibonacci level will just be traded if a fractal turnaround happens off that level.

Traders likewise tend to concentrate on trades at particular Fibonacci ratios. This might differ by trader, however state a trader chooses to take long trades, throughout a bigger uptrend, when the price draws back to the 61.8% retracement level.

Fractals could be contributed to the method: the trader just takes trades if a fractal turnaround takes place near the 61.8% retracement, with all the other conditions being fulfilled.

If going long on a bullish fractal, a trader might exist the position once a bearish fractal takes place. Other exits techniques might likewise be utilised, such as revenue targets or a routing stop loss.

Forex Fractals Trading Indicator

Fractals are indicators on candlestick charts that recognise turnaround factors in the marketplace. Investors frequently make use of fractals to obtain a suggestion concerning the instructions in which the price will certainly create. A fractal will certainly develop when a specific price pattern takes place on a chart.

Development Of An Up Fractal

Understanding exactly how the fractals are formed will help you as a trader to understand what you need to watch out for when searching for those high probability setups.

An up fractal develops when a candlestick has 2 candles to the right of it with 2 reduced highs and also a minimum of 2 candles to the left of it with 2 reduced highs.

A down fractal is developed when a candle has 2 candles to the right with greater lows as well as 2 candles to the left with greater lows.

The 5th candlestick needs to close to be a valid fractal

Given that a fractal is a five-candle pattern, the 5th candlestick in the collection needs to close as well as finish prior to any kind of trading choices can be based upon that specific fractal.

This is due to the fact that the price can relocate as the 5th candlestick is creating. If price actions either over the previous high or below the previous low, while the pattern is still creating, the fractal indication will certainly vanish from your price chart.

You have to wait for the pattern to finish in order to make certain that the fractal is validated.

Fractal Indicators Can Be Made Use Of To Establish The Marketplace Directions

As a Forex trader you can make use of fractal indicators to identify the feasible direction of price in a market.

One method which investors do this, is by searching for broken fractals. A fractal is thought about broken when a fractal has actually been verified and afterwards the price breaks either the high or the low of the fractal pattern.

If the price breaks an up fractal after that the direction of the marketplace is taken into consideration as to be up as well as if the price breaks a down fractal after that the marketplace is thought to be down.

Understanding this use with fractals, will work considerably well when applied into a fractal based strategy. A perfect example of such a strategy would be the fractal level trading strategy that you can find clicking here.

Making Use Of Fractals For Stop Loss Positioning

Another way you can use fractals as a Forex trader is to additionally usually utilise fractals to make a decision where to position stop-loss orders.

When getting in a brief setting you can make use of the most current up fractal to position your stop loss. Investors normally make use of the point of the fractals indicator for this, instead of the candlestick itself.

It is a great way for a trader to trail their stop loss while in a open position. This is a perfect strategy to locking in profits while in a open trade.

What Is Fractal Trading In Forex?

As I said earlier on in this trading lesson, Fractal trading is basically when you use a five bar reversal pattern and are one of the most basic repeating patterns and trends within the Forex markets.

The pattern itself consists of 5 candles and also the pattern shows where the price has actually had a hard time to go higher, in which situation an up fractal shows up or, in which instance a down fractal shows up.

Fractals can be applied as a trading indicator, which means traders do not need to hunt for a pattern and loose time. Some traders like to use fractals as part of a confirmation with areas such as; supply and

demand, trend lines and support and resistance.

The one drawback for using fractals in Forex trading is its a

lagging indicator.

Using a longer time frame will reduce the number of fractal signals on your charts. This will give your charts a cleaner look and will give you more of a chance of seeing trades. A fractal indicator works with any time frame and on any market.

The two perfect fractal patterns known are the bullish and the bearish fractals.

- a bullish fractal: The market is an uptrend and you are looking to buy.

- a bearish fractal: The market is a downtrend and you are looking to sell.

A perfect example of what a fractal would look like on a trading chart is show below.

Here is a summary of the fractal reversal patterns

- The patterns are made up of five bars or candlesticks.

- A bullish fractal shows that the downtrend has reached its end and there maybe a new uptrend occurring.

- A bearish fractal shows that the uptrend has reached the end and there maybe a downtrend occurring.

- A fractal is an indicator that shows future reversal points of the market.

- Fractal indicators can be used to established the direction of the market when the price breaks through the fractal high or low of the pattern.

- You can also use fractals to enable you to place stop losses.

Does Fractal Trading Work In Forex?

The short answer is YES… fractal trading does work, but not when used solely on it’s own, but part of a trading strategy.

A trader would benefit more with combining fractals with a strategy that follows the trend or a breakout trading strategy. Also combining fractals with technical analysis will greatly improve the odds of capturing winning trades.

You need to remember that fractals are a lagging indicator, and forgetting this crucial component with using fractals in Forex trading will be what makes or break your profitability.

How Do You Use Fractals In Forex Trading?

Fractals can be very useful when used with other indicators and techniques, but should not be relied on for success in trading.

One way of traders using fractals in Forex trading is by looking for broken fractals. A fractal is regarded broken when it has been confirmed when price breaks through either the high or low of the fractal pattern.

This type of method with using fractals in Forex trading would normally be associated with support and resistance trading. And known more as what is called a fractal breakout strategy.

1. Forex Fractal breakout trading strategy

Using fractals in Forex trading can easily be applied as a breakout strategy. Simply you would be able to mark of a previous fractal high or low created in the market.

Where a trader would wait for that level to be broken and closed to identify a valid breakout.

There are a couple of different types of breakout trading techniques that could be applied. There is the one candle breakout strategy, which would be where price breaks a fractal high or low and retest the fractal on the next candle.

A retest in Forex simply refers to price reversing direction after a breakout and returning to the breakout level to see if it will hold.

This can be an area of support that became a resistance, and acts as a retest. It is at this area of the retest a trader should look to enter the market, in the direction of the breakout.

You can learn more on this type of trading by checking out another trading lesson based around this type of trading strategy by clicking here.

When using fractals in Forex trading, you can also use the fractal indicator as a trend reversal indicator. This simply would be looking for price to break and close a fractal high or low to confirm the reversal.

If you would like a fully working fractal trading course, then click here.

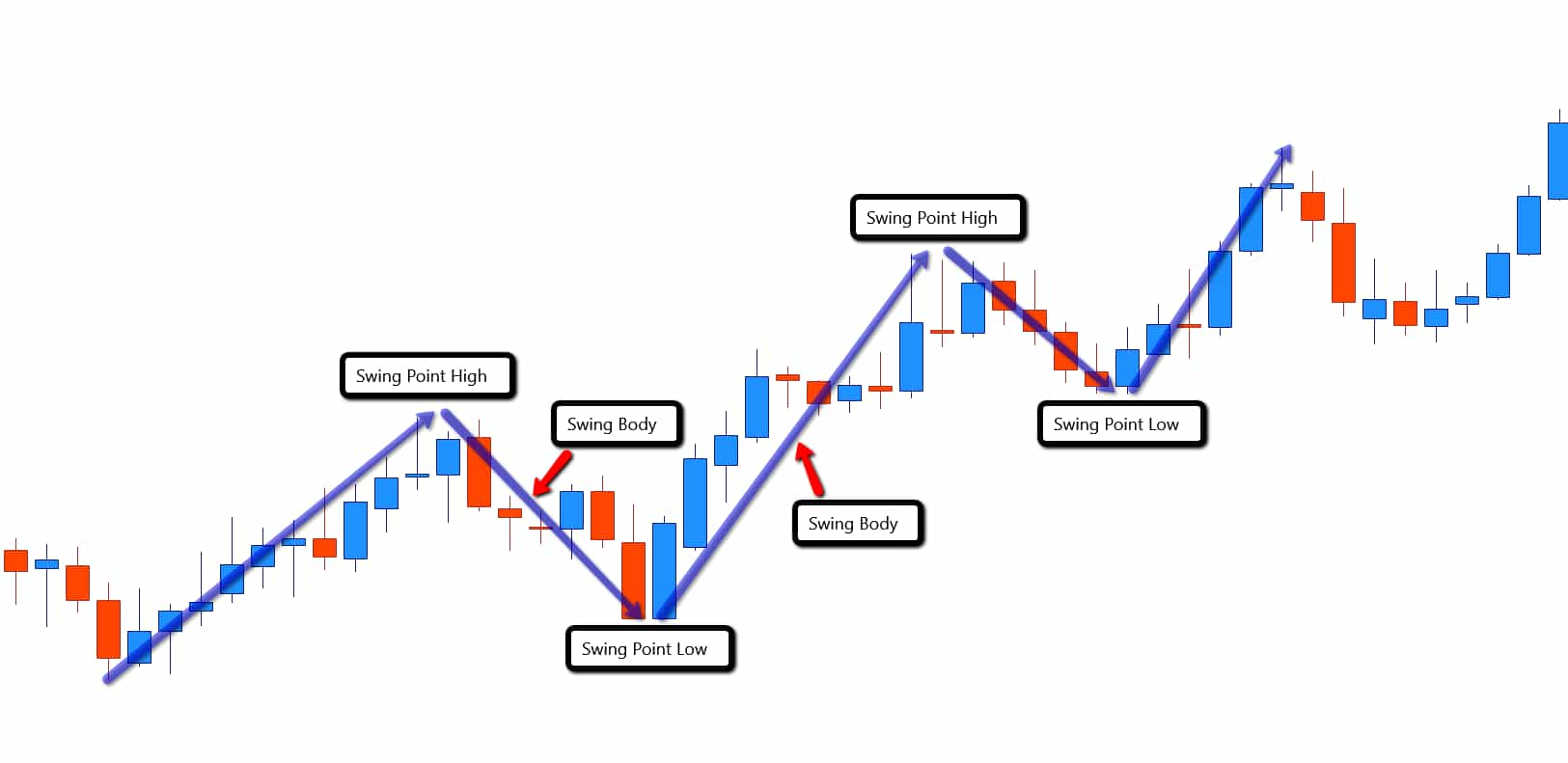

2. Forex Swing trading strategy

You can also use fractals with Fibonacci retracement levels. This means there are horizontal levels on the chart that indicate where support and resistance are more likely to occur.

This type of strategy with using fractals in Forex trading is associated with a swing trading strategy.

To learn more on a Forex swing trading strategy, you can do so by clicking here.

A Forex swing trading strategy is a style of trading whereby a trader attempts to profit from the price swings in the market.

These positions are usually open from a few days to a few weeks at a time. Swing trading is a fundamental type of short-term market speculation where positions are held for longer than a single day.

A trader would be able to use the fractal indicator to confirm the swing points in the market. Allowing the trader to pinpoint the swing high or low when searching for a swing pullback entry.

3. Forex Trend following strategy

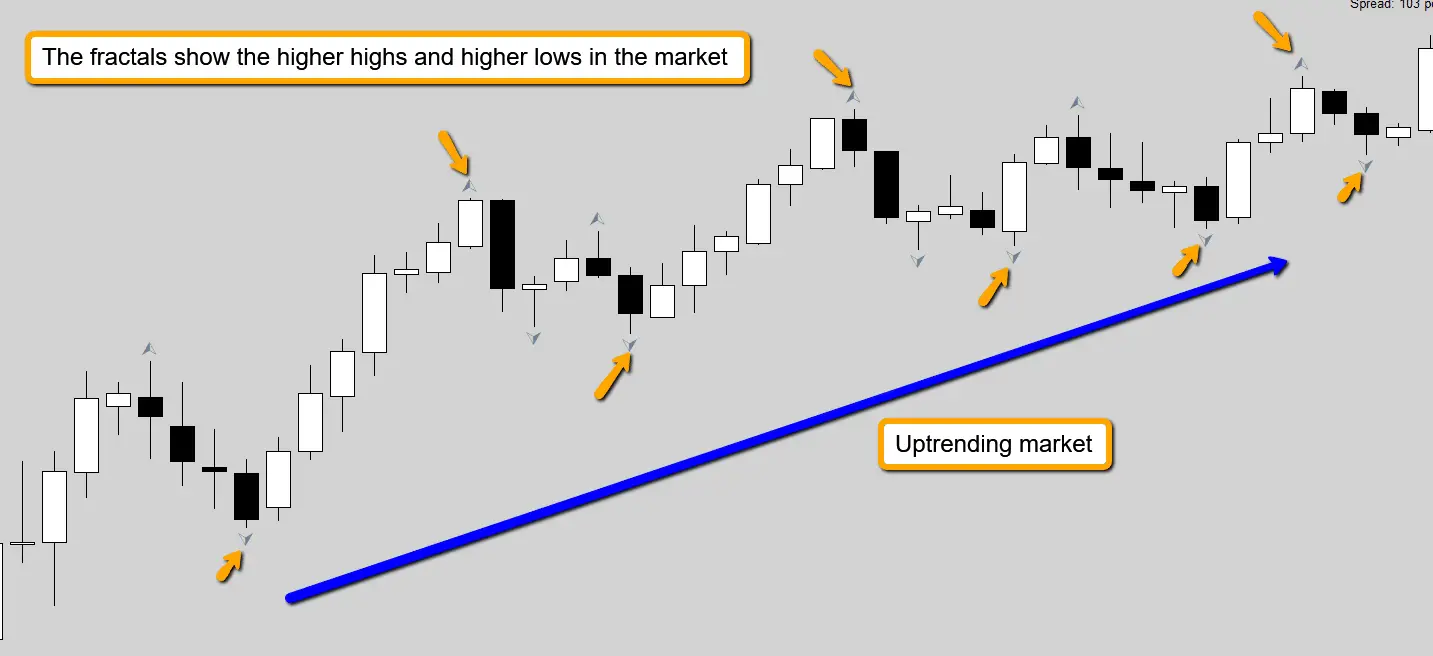

When using fractals in Forex trading, they can be applied to a strategy such as a trend following strategy. A trader would be able to determine the trend by using the fractals on their charts.

Fractal trading is designed to align you with the trend. The fractals indicator on a price chart will quickly identify fractal highs and lows. That may be of significance to a trader, and from these a trader can obtain signals designed to align them with the directional flow of the market.

With using a trend following strategy, the fractals would show a trader if the trend is bullish. By identifying higher highs and higher lows in the market. See below an example of how you could use fractals to identify an up trending market.

The opposite is true for a down trending market, fractals can show a bearish trend by identifying lower highs and lower lows in the market. See an example of how you could use fractals in Forex trading to identify a down trending market below.

A trader may wish to combine the trend following strategy with using fractals in Forex trading with a swing/breakout trading strategy. This would likely improve a traders potential results in the market.

Fractal Trading System That Really Works

When it comes to using fractals in Forex trading. A trader may wish to combine different strategies with using fractals. To allow a trader to develop a fractal trading system that really works.

As well as applying different strategies to use fractals as a trading strategy, you may also want to use fractals as a way of technical analysis.

Using fractals in Forex trading for technical analysis, would allow a trader to fine tune a entry with their strategy. One of the most used techniques of applying fractals for technical analysis is combining fractals with trend lines.

To learn more on my fractal trading secrets check out the fractal level trading course here.

Additional Factors To Consider On Utilising Fractals

When utilising fractals, here are a couple of things to keep in mind.

They are lagging indications.

Because fractals are really typical, they are best integrated with other indications or techniques. They are not to be counted on in isolation.

The longer the time duration of the chart, the more reputable the turnaround. It’s likewise crucial to keep in mind that the longer the time duration, the lower the variety of signals produced.

It is best to plot fractals in several timespan. Just trade short-term fractals in the instructions of the long-lasting ones.

As gone over, concentrate on long trade signals throughout bigger uptrends, and concentrate on brief trade signals throughout bigger drops. The majority of charting platforms now consist of fractals in the indication list.

The Bottom Line

Fractals might be beneficial tools when utilised in combination with other signs and strategies. Fractals can be utilised in numerous various methods, and each trader might discover their own variation.

Remember fractal trading is basically when you use a five bar reversal pattern and are one of the most basic repeating patterns and trends within the Forex markets.

Also using fractals in Forex trading can be applied as a trading indicator, which means traders do not need to hunt for a pattern and loose time.

Unfortunately the one drawback for using fractals in Forex is its a

lagging indicator. Which means you can not rely solely on using the fractal indicator to trade with.

Fractal trading does work, you just need to remember the fractal indicator should not be relied on for success in trading.

You can use fractals in Forex trading, with a breakout, swing and trend following strategy. And if you really want a fractal trading system that really works. You just need to combine your strategy with technical analysis.

Click here for more trading lessons.