Do you find yourself asking this same question over and over… with what does retest mean in Forex? If you do and want to know exactly how waiting for the retest will make you a better trader. Then you’re in the right place!

A retest in Forex simply refers to price reversing direction after a breakout and returning to the breakout level to see if it will hold. This can be an area of support that became a resistance, and acts as a retest. It is at this area of the retest a trader should look to enter the market, in the direction of the breakout.

Should you trade the breakout, or wait for a retest?

This question for me, is really a simple one to answer. From my own personal experiences, I have found that waiting for the retest wins every time! So if you are considering trading the breakout instead you need to read this first…

I’m super excited to be sharing this lesson with you! This was one of my biggest concerns when I started trading, with what does retest mean in Forex and if I should be entering on the breakout or waiting for that retest.

In other words, If a currency was to breakout of a technical price pattern such as the double top, at the baseline. Should you wait for the breakout and retest of new resistance or trade it on the breakout?

So what am I to do?

While it’s going to be subjective and have discretion, in my Forex trading guide I am going to cover some rules to help you decide which trading decision is going to be best for you!

Perhaps you are looking for a strategy that uses this type of entry strategy, if so then you will want to check out the Forex trading made easy course now by clicking here.

What is discretion?

Basically, this means that each individual trader will look at their charts and trade them differently.

But using my my guide will help you find that sweet spot for your own trading and give you a positive mind set when missing those trades.

Let me clear one thing up with what does retest mean in Forex…

Myself, I personally never trade breakouts, I now always prefer to trade the retest. But this lesson isn’t about how I trade or for me to tell you how you should trade.

It’s giving you the right information so you can become a better trader! With that said, if you are new to this type of trading, with using price action and technical price patterns. I recommend you gain a good education with understanding the markets.

Lucky for you!

You’ll find everything you need on my site, first I suggest to get a good grasp of the Basics of Forex Trading. and then… moving onto more advanced trading lessons such as a Forex Swing Trading style of trading. As I said… I have put together in this Forex trading guide with what does retest mean in Forex, some rules for you to follow.

So are you ready to get started?

Then lets crack on with the first rule of my guide…

What’s Your Trading Style?

For me this is the most important rule with what does retest mean in Forex!

Why?

This always gets overlooked by traders when they start trading the Forex markets! The problem I see occurring, on a continuing basis is most traders spend the majority of their time when starting out in trading searching on the internet.

Trying to find that next magic formula… or indicator that’s going to turn them into wealthy millionaires over night!

Where you should be taking this time reflecting on what you need, to succeed at trading instead.

In other words, spending your time more wisely and identifying: what your own style of trading is, and how this would suit your needs and personality.

You already know by now what my style of trading is, with being a breakout and retest trader! Now take this time to reflect and decided where your future goals and personality lay with your own trading style.

Start experimenting…This will involve you searching for ideas most likely on google etc… But it’s just to see what suits you best! You’re not their searching for the next magic formula, your’e there to get some ideas flowing!

What does all this have to do with what does retest mean in Forex trading?

Everything!

When it comes to a traders personalty, some may feel more comfortable waiting for the retest. For an example lets take two trader persona’s…

First is “Larry” he’s the breakout and retest trader. Even if this means that Larry misses some trading opportunities with being a breakout and retest trader, with him not taking the breakout.

But as a retest trader…

Larry will add this into his trading plan, and by doing this it will not give his confidence a knock when he misses trades! The breakout trader being “Barry” may feel more comfortable with taking higher risks and being a more aggressive trader with trading the breakout.

And…

falls into his personality with not wanting to miss a trade with waiting for the retest. While this isn’t my style of trading, some traders may feel more comfortable with this approach and find that they are more profitable.

So it all comes down to your own personality and how you feel with each type of trading when it comes to the risks and your own emotions. Lets now cover with what does retest mean in Forex trading, the differences between the breakout and the retest.

What Is A Retest?

You should now know, what your personalty is when it comes down to trading the breakout or waiting for the retest. What I’m now going to cover with what does retest mean in Forex. Is what is a retest and what is a breakout with the two types of trading will look like.

Obviously… you can have both types occur on any trade you may take. There can be the breakout entry first that occurs then the retest afterwards.

So what is involved with trading the breakout?

How To Trade Breakouts In Forex?

With what does retest mean in Forex: Trading the breakout…

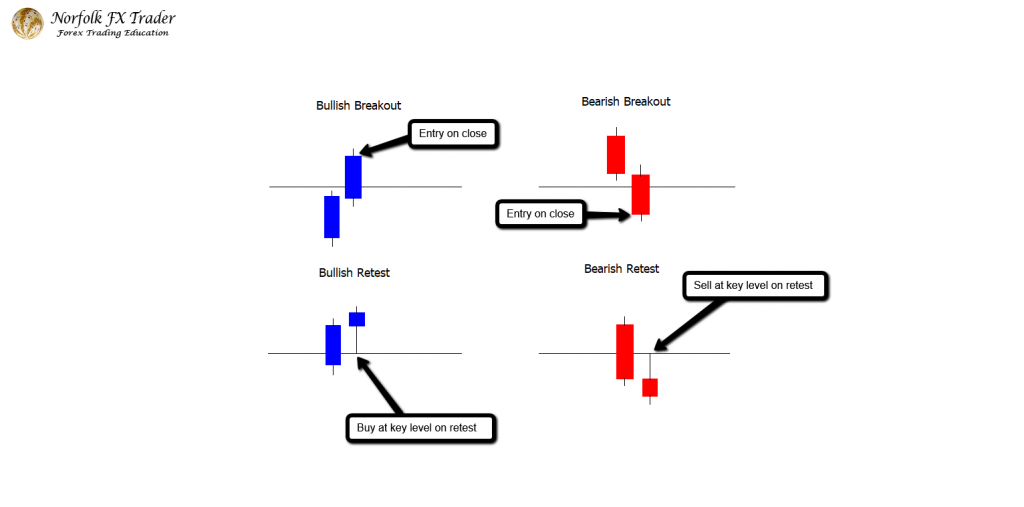

This being when a trader does not wait for a retest and will take an entry after price breaks and closes a key level. On the other side of the coin, will be “trading the retest” where a trader will wait for the breakout. And… for price to return to test the broken key level as a new support or resistance before entering into the trade.

The retest part can be from a single candle retest or from a swing retest. Generally if you’re a swing trader you might always wait for the breakout of price, with the move away and then the swing retest. Using support and resistance with your trading, with waiting for the price flip from a broken resistance to act as a support.

You can increase your ability to reading the markets with checking out a recent article I wrote on the difference between support and resistance by clicking here.

That’s good for a swing trading strategy…but what about catching it on a breakout/retest with momentum?

This will generally be from the one candle retest: after the breakout, you would look for the next candle to give the key level a one candle retest to catch a entry. See the diagram below that will show the breakout entry and the one candle breakout and retest of a key level for a entry…

You may be asking yourself, why would anyone want to trade the breakout. When the retest is going to give you a much greater risk to reward!

One reason…

Is price doesn’t always come back to test the broken key level. In fact more times you will see a breakout just continue with never giving a retest. Simply put, this is due to the momentum in the market, when price is breaking a key level. It will on most occasions be doing so after a build up of orders.

Creating the break to be with momentum!

Back to the risk to reward… when trading with the retest, this will give you a much greater risk to reward on the trade. Perhaps being the single reason why many traders move to this trading approach!

A Better Risk To Reward!

Perhaps one of the most important parts to a traders trading plan.

Is only taking trades which have a good risk to reward. This can be what actually makes or breaks a traders end game. Do you struggle to make good risk to reward trades?

I went through the same challenging phase when I started. Myself, I personally won’t take any trades unless there is at least a 2-1 risk to reward.

I always use good risk management with taking away risk on any given trade as soon as possible.

What should I look at as a desired risk to reward?

This comes… all down to your own personal preference, I cannot really advise you on what is ideal for your own risk appetite. It is important that you find your own minimum risk to reward that you are happy with. This one rule can be what determines your outcome with trading the breakout or the retest for an entry.

For example…

If you have a retest entry, this will give a greater risk to reward than taking the breakout. If you have a set minimum of a 2-1 risk to reward but this is only achievable from the retest option, this will greatly persuade you to only look to trade the retest option.

This being another reason, why I only trade the retest entry myself.

My final rule with what does retest mean in Forex…

Is being able to read the currency pair you are trading, as each pair will have it’s own personality.

A Currency’s Personality

What do you mean?

We’ll as one pair might be breaking a key level with no pause in price showing a strong trend is in the market. This may signal that a retest may very well not occur. Where another currency pair you are watching with a similar breakout, may be having a slightly more choppy trend, giving you a clue that the retest is more likely to occur!

How to approach this?

The best way to approach this, would be to observe how previous price action has developed before on the currency pair you are trading. More so… how this pair has reacted over the previous few days or weeks. Depending on the time frame you are trading.

Perhaps the best way to demonstrate this will be with an example.

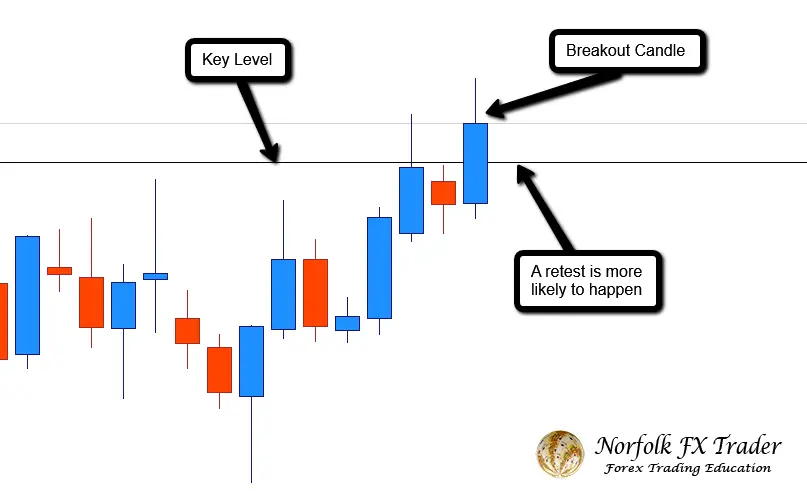

On the chart above, price is more likely to give the retest. Look at the structure of price as it approached the key level before the breakout.

Why does this matter?

Price made a few pauses along the way, demonstrating that there is less momentum in this currency pair. You could say… this currency was a choppy market, and when trading such a pair as this, it’s often best to wait for the retest for an entry.

Even before the breakout candle, price gave a pause again before being able to breakout of the key level. Lets see an example of when you wouldn’t expect price to give the retest for an entry.

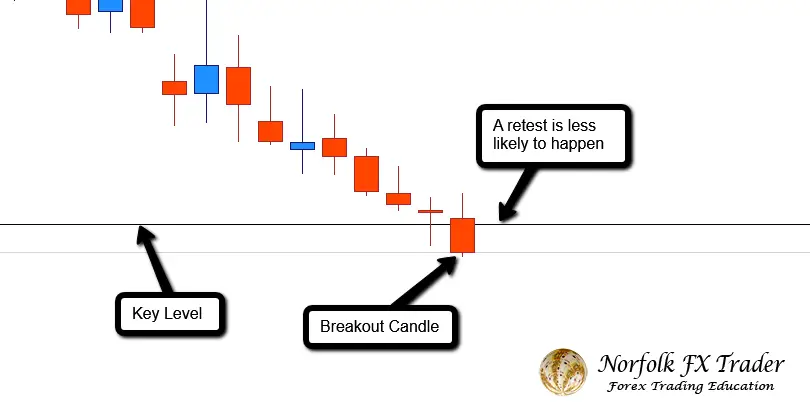

On the other side of the scale…

Price on this chart is demonstrating a much stronger price movement, with a strong bearish trend. Even with the pause at the key level before the breakout, still I would expect this market to head south strongly without a retest.

In other words…

This chart is a much more cleaner chart with showing a strong bearish bias and momentum. Hence why it is more unlikely for the retest to occur with such a currency pair.

If you find that you struggle to see which is the best way to trade, then you might want to check out trading with a raw price chart, you could say trading totally naked by clicking here.

Conclusion

Conclusion With What Does Retest Mean In Forex?

There is going to be many factors, if you will take the breakout or the retest entry.

Above all…

It will all come down to your own trading style and personality, if you’re not confident about your trading decision then you are not trading a style that meets your own style.

You need to always remember if it meets your minimum risk to reward. If it isn’t then you are taking the wrong setups! This one alone will force you to wait for a retest entry than the breakout.

Plus…

Paying close attention, to how each currency pair is moving with current price, will give you an advantage with knowing if the pair is likely to give the retest or NOT!

Just remember,

When it comes to trading either the breakout or the retest entry. It’s not what works best, but what works best and suited to your own needs and personality.

For more basics of Forex trading click this link.

Click here for more trading lessons