Do you need to know what the top Forex market trading mistakes are, and how they could be causing you to lose trading profits?

If so, I’m going to cover the top 14 Forex market trading mistakes and the same steps I took when losing profits, so you’re in the right place!

The main Forex market trading mistakes that most traders make, are trading the wrong time frames. Missing key levels of market structure on their charts, and marking out technical price patterns on their charts incorrectly. And finally trading too soon, not confirming the technical price pattern with an entry.

The key to understanding why the markets actually move the way they do is being able to determine and identify potential chart patterns.

Once you can master this number one tip, you will have the confidence and knowledge to trade any Forex pair.

Check out my Basics of Forex trading section for more about chart patterns.

In this post I will cover the top reasons why you might very well be making mistakes in your own trading, then I will go through how you can change the way you trade.

You won’t want to miss the final 4 MISTAKES with fixes at the end section of this post, as I cover the top Forex market trading mistakes beginner traders make.

Is it really that simple with Forex market trading mistakes?

It is when you look at it from a technical standpoint. So why is it so many Forex traders fail to generate consistent profits with their trading?

What I have come to find, is that the majority of traders fail with their trading, from a psychological aspect.

It’s not what you would perhaps expect, with it being down to their personal experience level with reading the charts.

At the end of the day we are all humans, we tend to make things too complicated for ourselves when in fact it just needs to be the “Kiss” principle (keep it simple stupid!)

Patience and trading discipline is another large factor when it comes to trading the markets. We’ll, it played a big roll for me when I started out with Forex market trading mistakes.

Consistent Profits

There are many other factors rolled into trading when it comes to having a consistent gain.

But the use of technical patterns to search for trade ideas is as simple as they come, when trading the Forex markets.

I know it’s easy for me to sit here typing this right now, saying trading is simple when applying the use of technical patterns.

So if you’ve been struggling to make a consistent gain, or find it hard to keep things simple, you’re in for a treat!

Below are 14 of the most common Forex market trading mistakes I believe new traders make when trading.

But by the time you have finished reading my post today, you’ll have a much better understanding what you could be doing wrong and what you need to change!

The fx market (foreign exchange) has a reduced obstacle to access, that makes it among the globe’s most available day trading markets. If you have a computer system, a web link, as well as a couple of hundred bucks, you ought to have the ability to begin day trading.

This easy-entry is not a pledge of a fast revenue. Prior to you start, take into consideration these 14 typical blunders you ought to stay clear of, as they are the major factors brand-new foreign exchange day investors stop working.

1. If You Keep Losing, Don’t Keep Trading

There are 2 trading data to maintain a close eye on: Your win-rate as well as risk-reward proportion.

Your win-rate is the number of trades you win, shared as a percent. If you win 60 trades out of 100, your win-rate is 60%. A day investor must function to preserve a win-rate over 50%.

Your reward-risk proportion is just how much you win about just how much you lose on a typical trade. If your standard losing trades are £50 and also your winning trades are £75, your reward-risk proportion is £75/£ 50= 1.5. A proportion of 1 shows you’re losing as high as you’re winning.

Day investors ought to maintain their reward-risk over 1, and also preferably over 1.25. You can still pay if your win-rate is a little bit reduced as well as your reward-risk is a little bit greater, or the other way around.

Attempt to maintain it straightforward though, and also create approaches that win greater than 50% of the moment as well as supply a much better than 1.25 reward-risk proportion.

2. Trading Without a Stop Loss

You ought to have a stop-loss order for every single foreign exchange day trade you make. A stop-loss is a countering order that obtains you out of a trade if the cost actions versus you by a quantity you define.

When you have a stop-loss order on your trades, you have actually taken a huge part of the danger out that financial investment. If you begin taking losses on a profession, the stop-loss stops you from losing greater than you can take care of.

3. Contributing to a Losing Day Trade

Balancing down is contributing to your placement (the cost you bought the profession at) as the rate steps versus you, in the misconception that the pattern will certainly turn around.

Contributing to a losing trade is an unsafe method. The cost can relocate versus you for a lot longer than you anticipate, as your loss obtains significantly bigger.

Rather, take a trade with the correct setting dimension as well as established a stop-loss on the trade. If the price strikes the stop-loss the trade will certainly be shut at a smaller sized loss than it would certainly have without it.

There is no factor to run the risk of even more than that.

4. Running the risk of More Than You Can Afford to Lose

The essential component of your threat monitoring technique is to develop just how much of your funding you agree to run the risk of on each trade.

Day investors preferably must run the risk of much less than 1% of their resources on any kind of solitary profession. That implies that a stop-loss order liquidates a trade if it causes no greater than a 1% loss of trading resources.

That implies that also if you lose numerous trades in a row just a percentage of your resources will certainly be lost. At the very same time, if you make greater than 1% on each winning trade your losses are recovered.

One more facet of danger administration is regulating day-to-day losses. Also running the risk of just 1% per trade, you might lose a considerable quantity of your funding in a solitary negative day.

You ought to establish a percent for the quantity you are prepared to lose in a day. Day trading can end up being a dependency if you allow it.

5. Going All In (Trying to Win It All Back)

Also if you have a threat monitoring approach in position, there will certainly be times you will certainly be attracted to neglect it and also take a much bigger trades than you usually do. The factors differ, and also you’ll be alluring destiny to do her worst.

You could have had numerous losses in a row, which will certainly make you wish to gain back several of the losses. A winning touch can make you really feel as if you can not lose. There will certainly constantly be one trade assuring such great returns, you want to run the risk of nearly whatever on it.

If you take the chance of way too much you are slipping up, as well as errors have a tendency to intensify. Investors have actually been recognised to their stop-loss order in the hopes of a turn-around.

Several additionally obtain captured up maintaining their margin, informing themselves it will certainly reverse and also they’ll win huge.

When you feel in this manner, adhere to your 1% threat per trade policy as well as your 3% threat each day guideline. Withstand lure, adhere to your danger administration approach as well as prevent going done in or contributing to your setting.

6. Attempting to Anticipate the News

Numerous sets (2 supplies– one long, one brief, both associated) surge or drop dramatically following scheduled financial press release. Expecting the instructions both will certainly relocate, as well as taking a setting prior to the information appears, looks like a simple method to make a windfall earnings.

It isn’t.

Typically the cost will certainly relocate both instructions, dramatically as well as swiftly, prior to selecting a continual instructions. That implies you are equally as most likely to be in a large losing trade within seconds of the press release as you are to be in a winning trade.

There is an additional trouble. In the preliminary minutes after the launch, the spread in between the quote as well as ask cost (highest possible acquisition rate and also cheapest market rate) is commonly much larger than common.

You might not have the ability to locate the liquidity you require to leave your setting at the price you desire (utilising smaller sized trades to leave the placement).

As opposed to expecting the instructions that information will certainly take the marketplace, have an approach that obtains you right into a trade after the press release.

You can benefit from the volatility without all the unidentified threats. The non-farm pay-rolls forex approach is an instance of this method.

7. Select the Wrong Broker

Transferring cash with a foreign exchange broker is the largest profession you will certainly make. If it is improperly taken care of, in economic difficulty, or a straight-out trading fraud, you can lose all your cash.

Take time in selecting a broker. Examination the broker making use of tiny trades at initially, and also do not approve deals of bonus offers with their solutions.

8. Take Multiple Trades That Are Correlated

You might have listened to that diversity is great. Diversity is an approach that depends upon your expertise, experience, and also what you are trading. Warren Buffett as soon as stated concerning diversity:.

” Diversification is defence versus lack of knowledge. It makes little feeling if you understand what you are doing.”.

If you count on diversity you might be inclined to take numerous day trades at the exact same time rather than simply one, believing you are spreading your threat.

Possibilities are you are really enhancing it.

When sets are associated, they relocate with each other, which implies you will possibly win or lose on all those trades. If you lose, you have actually increased your loss by the number of trades you made.

If you take several day trades at the exact same time, see to it they relocate individually of each various other.

9. Profession Based on Fundamental or Economic Data

It is simple to obtain captured up current of the day or to create a predisposition based upon a post you check out that claims financial problems are excellent or negative for a specific nation or money.

The lasting basic overview is unimportant when you are day trading. Your only objective is to execute your method, regardless of which instructions it informs you to trade. Poor financial investments can rise briefly, as well as great financial investments can drop in the temporary.

Basics have definitely nothing to do with temporary rate activities- making use of essential evaluation creates you to concentrate on the incorrect ideas and also develop prejudices.

Any kind of lasting prejudices can just trigger you to differ your trading strategy. Your trading strategy and also the methods it includes are your overview out there as well as stop you from taking unneeded threats, or gaming.

10. Trading Without a Plan

A trading strategy is a created record that details your method. It specifies exactly how, what, and also when you will certainly day trade. Your strategy needs to include what markets you will certainly trade, at what time as well as what period you will certainly make use of for examining and also making trades.

Your strategy ought to describe your danger administration policies and also need to detail specifically just how you will certainly get in as well as leave professions for both winning and also losing trades.

If you do not have a trading strategy, you are taking unneeded wagers. Develop a trading strategy as well as examination it for earnings in a trial account or simulator prior to attempting it with actual cash.

If these pointers appear comparable to cautions concerning gaming, it is since they are. Day trading, or supply trading generally, can trigger individuals to win and also lose a ton of money in a day.

Current researches as well as concepts behind uncontrollable trading dependency are obtaining stamina (for legitimate factors), as well as you need to watch for the indicators.

Preparation and also performing anything takes perseverance, ability, and also technique. As you obtain much deeper right into day trading, you must tip back and also change your strategy as time goes on.

11. Trading The Wrong Time Frames

When most traders start out in Forex market trading, they feel the need to be active in the markets every day.

Whether it’s from what they’ve seen another trader do or they just believe a Forex trader is someone who is always trading.

The real truth with Forex market trading is…

Many great traders throughout the world understand the importance of sitting on the side-lines knowing when to be patient. As a great saying goes;

“having the power to do nothing, is always going to be greater than doing something.”

This is exactly what a trader should be doing when it comes to trading the financial markets. Especially with being selective with the way you risk your capital.

The biggest mistake most traders make, when it comes to trading the wrong time frames. More likely when starting out, is the ability to trade more frequently.

A new trader tends to believe if they trade more setups this would lead to making them more profits.

Ultimately, I’m here to tell you it’s the complete opposite!

In fact, Forex market trading is going to be vastly different to any other endeavour you have tried before.

Where perhaps other endeavours, where more-is-better approach works in Forex trading it doesn’t!

To understand the different types of time frames you can trade and what works best take a look at my recent article I wrote on the best Forex trading strategies, and pay more detail to the higher time frame approach with a Forex swing trading strategy.

Higher time frames will with out a doubt give a trader better trade signals when using technical patterns. I say this from past experience, even when I started out with trading I took the same route with thinking trading the lower time frames was best.

I soon realised this was complete rubbish, and I needed to be trading higher time frames to see positive results. Why does a higher time frame give you better signals when using technical patterns? I’m sure you’re asking this question right now!

Where the lower time frames of 5-15 minute charts may seem like a good choice when starting out. Unlike the Daily time frame, they are full of noise.

What does noise mean, you ask?

Great question!

Noise is from the lower time frames where they show a days worth of price action. Where a Daily time frame will show all of this movement within only one candle.

So where you will find a very noisy “choppy” chart on a lower time frame, the Daily can filter out this noise. Put another way, it helps to normalise price action during the increased volatility periods.

Lets now see this as an example on a chart-

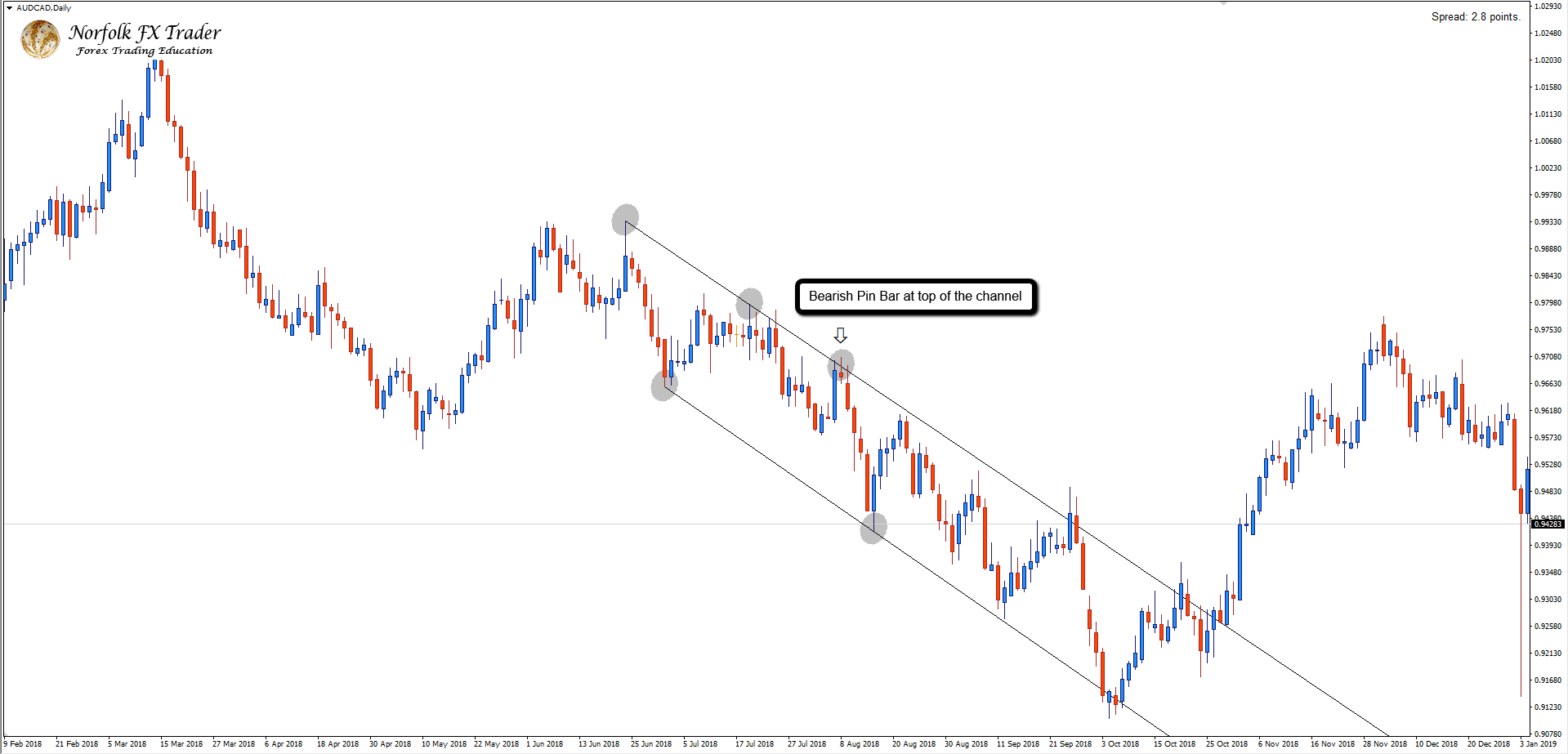

As you can see from the daily chart above, the AUDCAD had a long standing descending channel formed.

If you now take particular note of where the retest occurred with the arrow above. Price never actually broke through the channel top.

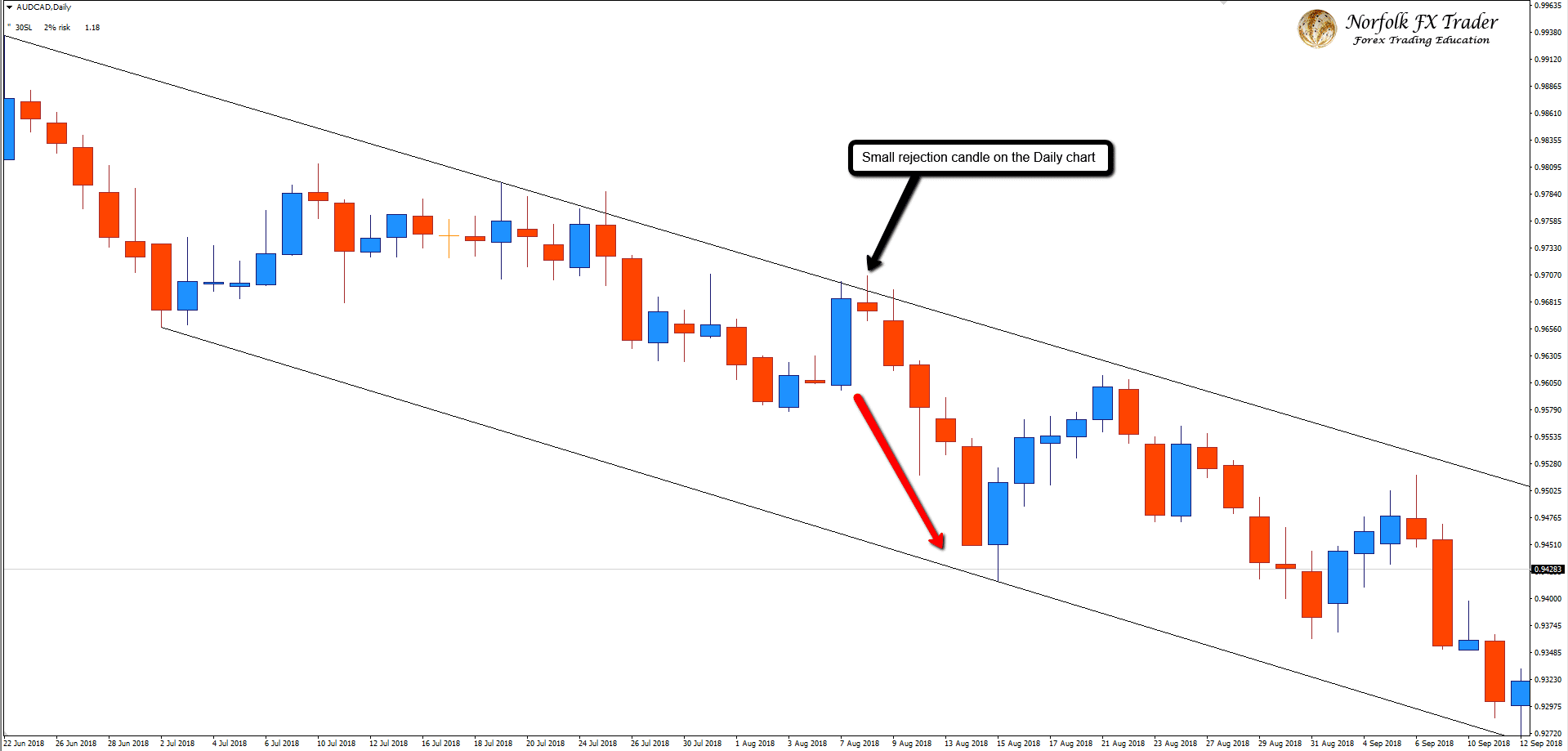

Using the 4-hour time frame that you will see below, even shows a close beyond the outer limits of the channel. Without needing to go to a lower time frame the 4-hour shows the false breakout of the descending channel as well.

Extra Volatility in Forex market trading

It just so happens the markets where volatile on this particular day. Showing even the 4-hour time frame was susceptible to a false breakout such as this.

The traders who already had the patience and remained watching the AUDCAD on the daily time frame.

Became the ones who reaped the rewards out of this setup! Not only that, but they also preserved their trading capital not getting sucked into the 4-hour false breakout.

With a daily small pin bar (rejection candle) giving a trader a nice entry to catch the next move lower on this descending channel for a nice 200+ pips.

My Solution to this mistake:

You guessed it!

Stick to the daily time frame and anything higher. Myself I trade the daily time frame and make most of my analysis of both the daily and weekly time frames.

I do still move down to the 4-hour time frame as well from time to time, to fine tune my entry point but never anything lower!

However my recommendation, if you’re new to Forex market trading is to stick with the daily time frame until you see a consistent flow of profit.

Only then, should you consider to begin to venture to any lower time frames, to search for a better entry point.

Now you know, STOP wasting your time trading those lower time frames and start becoming a consistent trader today with the daily time frame!

12. Missing Key Levels

I know, you’re already asking yourself how can I miss key levels when I’m trading the levels that make up the technical pattern.

Let me start this section of with answering that question first, then I will dive into those key levels themselves.

Missing those key levels is indeed possible, but the key levels I’m referring to are the ones that are formed by swing highs and swing lows in the market.

Measured Objective with Forex market trading

Most technical patterns, use what is called a measured objective. While these are great for traders to find profit targets with technical patterns.

They can also become very dangerous to a trader as well, when they go blindly setting profit targets without considering other critical key levels at surrounding price action.

The easiest way for me to demonstrate this, is with a price chart below.

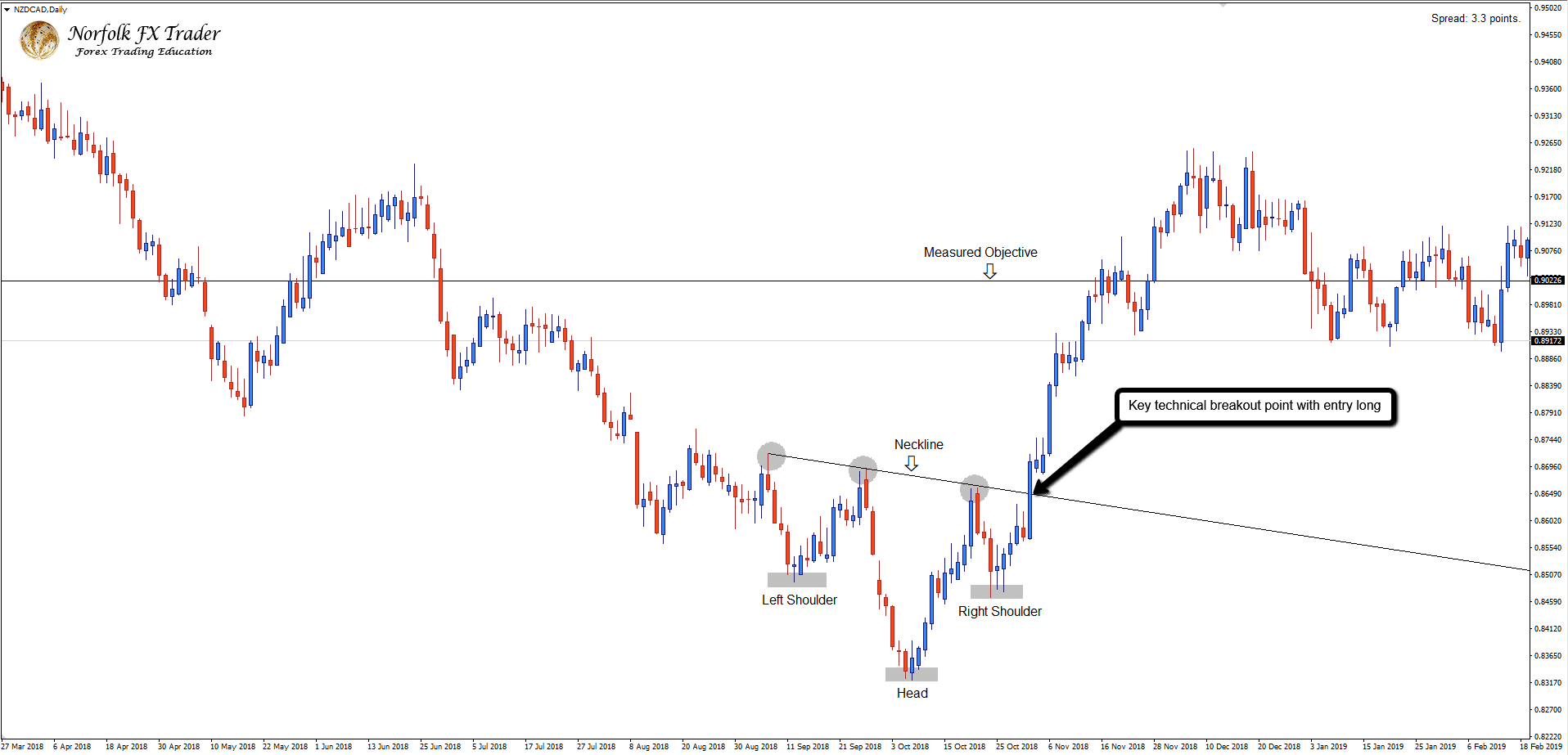

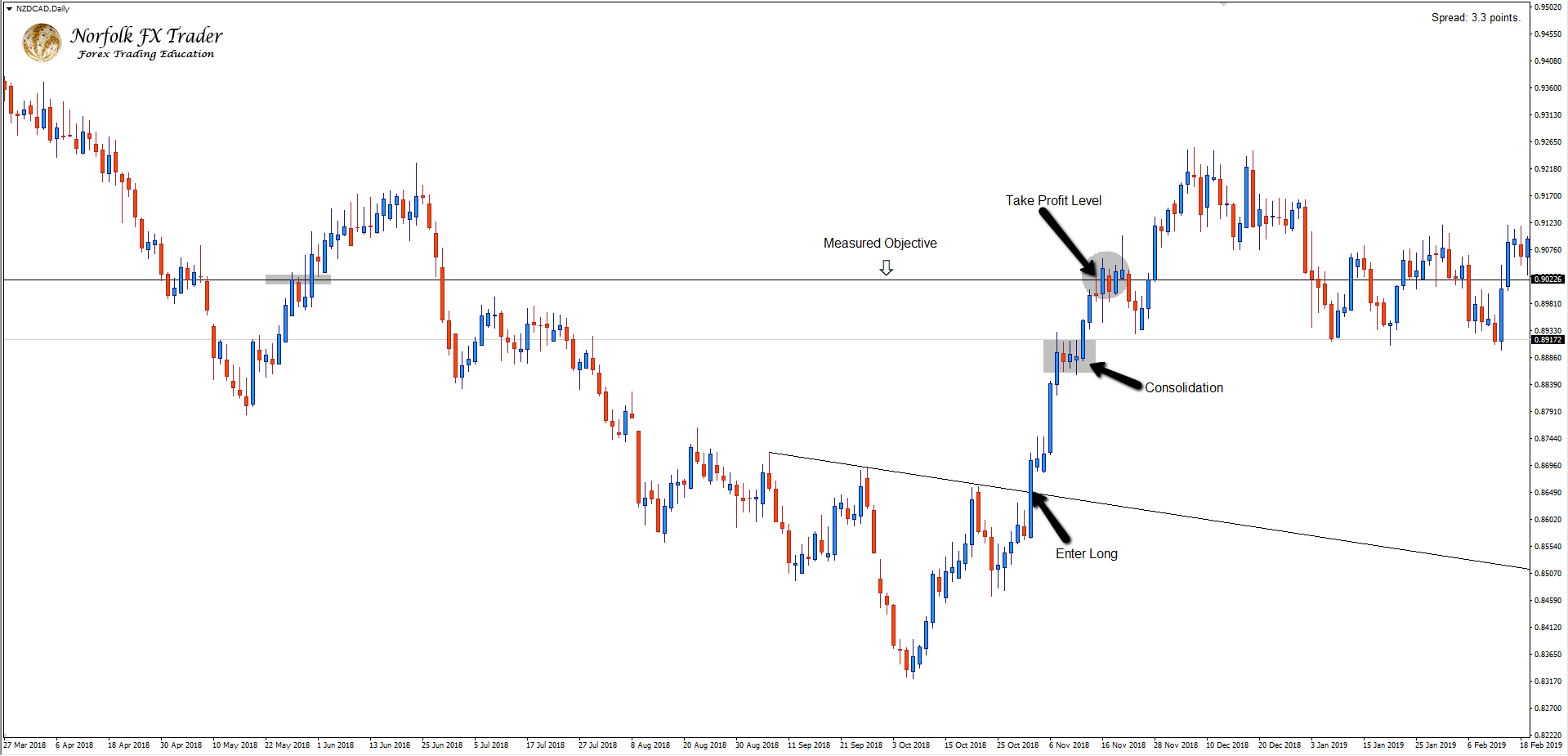

The chart above shows an inverted head and shoulders pattern, that had formed on the NZDCAD Daily chart.

For more on this technical pattern and other reversal price patterns. With turning you into a more profitable trader, you can study on another previous article I wrote by clicking here.

The measured objective for this formation was a healthy 375 pips.

With any technical price patterns like this, you just can not expect the move to be direct to the profit target.

This setup was no exception, with some bumps along the way.

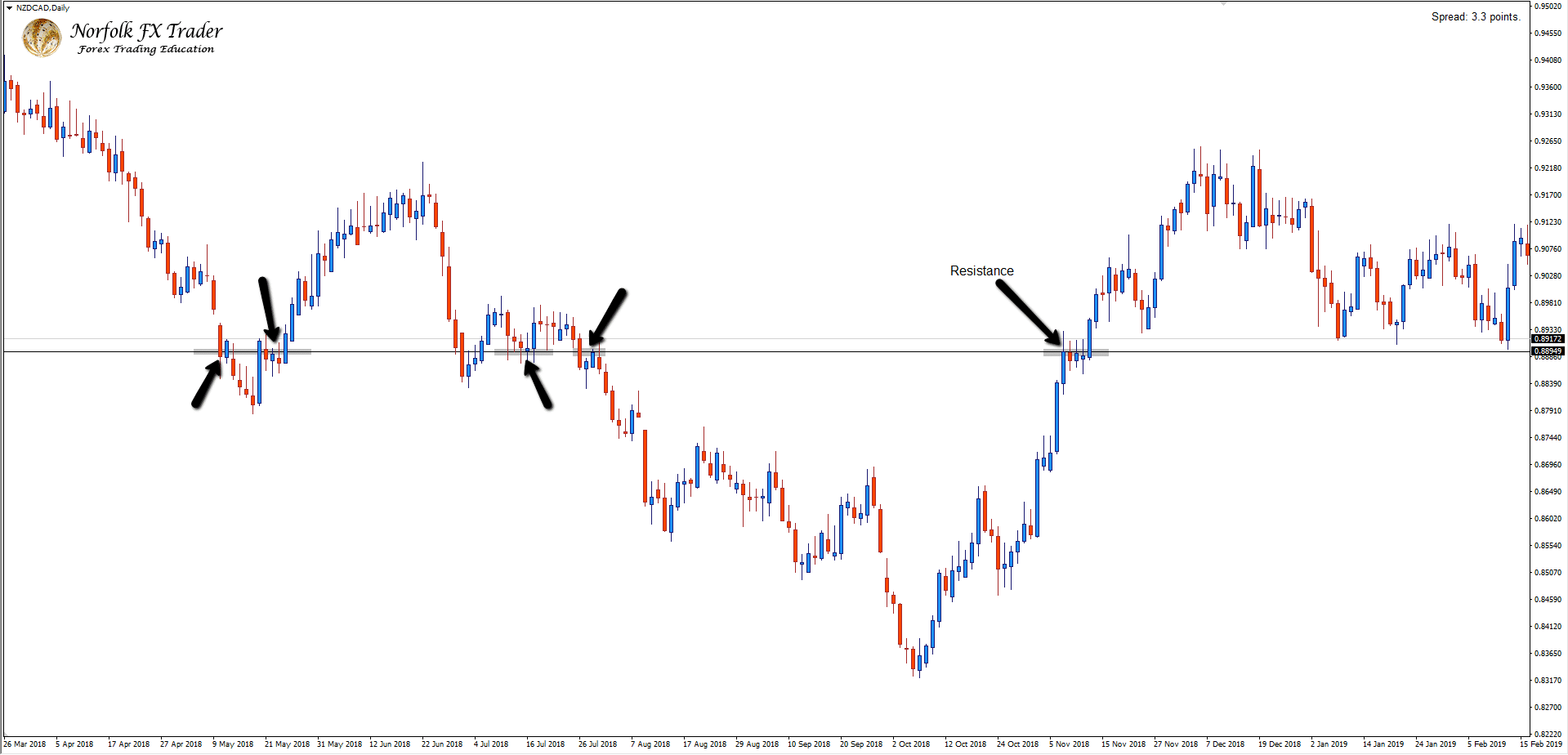

After breaking the neckline, NZDCAD found some resistance at an area of value on the chart.

Doing chart analysis correctly with Forex market trading:

If I hadn’t done my analysis here correctly and made myself aware of the potential key level of resistance above the entry. I might have panicked and exited the trade early.

But understanding the value of checking for key levels on my chart as well as technical pattern levels, I knew this level existed.

And was going to be highly likely, I would see some selling pressure or profit taking occur at this key level.

I also knew from this placement on the chart with the recent break of the inverted head and shoulder neckline.

Was going to become more influential than the level of resistance that lay ahead. Thus deciding to hold onto this position to the final measured objective profit target.

Sure enough, this trade did pause right at the resistance level with a small consolidation before breaking through to the final measured objective profit target.

Next time frame lower for more clues:

Moving down to the 4-hour time frame, I could see this consolidation that took place at the resistance key level.

It in fact formed a bullish consolidation continuation price pattern. Which you can read more on continuation price patterns, and how you could start making big profits. With heading over to another article I wrote by clicking here.

Seeing this forming on the 4-hour time frame gave confidence price would break bullish continuing to the final target.

It also gave another opportunity to add to this already bullish momentum in the market.

Because I had already made myself aware of this resistance level before entering into the trade, I gave myself two options

- Take profit at this key level of resistance

- Look to hold the trade to the final measured objective target

Which option I actually took here is irrelevant.

What I’m trying to say, is understanding where all the critical levels are before ever committing to entering a trade.

Will allow you to give yourself options, preparing you for every possible outcome that could potentially come.

Taking this trade as an example, I was able to react logically than emotionally. After seeing the bullish consolidation continuation pattern that formed on the 4-hour time frame.

My Solution to this mistake:

When ever you look to take any trades, always mark of your support and resistance levels. If you struggle with understanding how to use support and resistance with your trading and want to know the difference between support and resistance. You can find out by reading through another article I wrote by clicking here.

This will therefore give you options before entering into each and every trade you now take. You will now get to see and prepare for every possible outcome.

When trading technical patterns, don’t just use the measured objective by itself. Always look to identify possible swing highs or lows within the market that fall within your trade direction.

Allowing you to plan each trade out, taking away the emotions with your trading. Therefore making each trade decisions, a logical one!

13. Marking Out Technical Patterns Incorrectly

This mistake traders make, could very well be the biggest mistake of them all! When marking out technical patterns, I see many traders draw them incorrectly.

How does the typical Forex trader get this wrong with Forex market trading?

For some unknown reason many traders will mark the pattern with Forex market trading, with shaving off the candle wick highs and lows. When you do this, you are hindering your ability to trade the pattern successfully.

With making it more difficult for a trader to identify the breakout of the pattern. Above all, it will also make it even more tougher to determine an actual entry.

Lets investigate this further, by checking out a chart showing exactly what I mean.

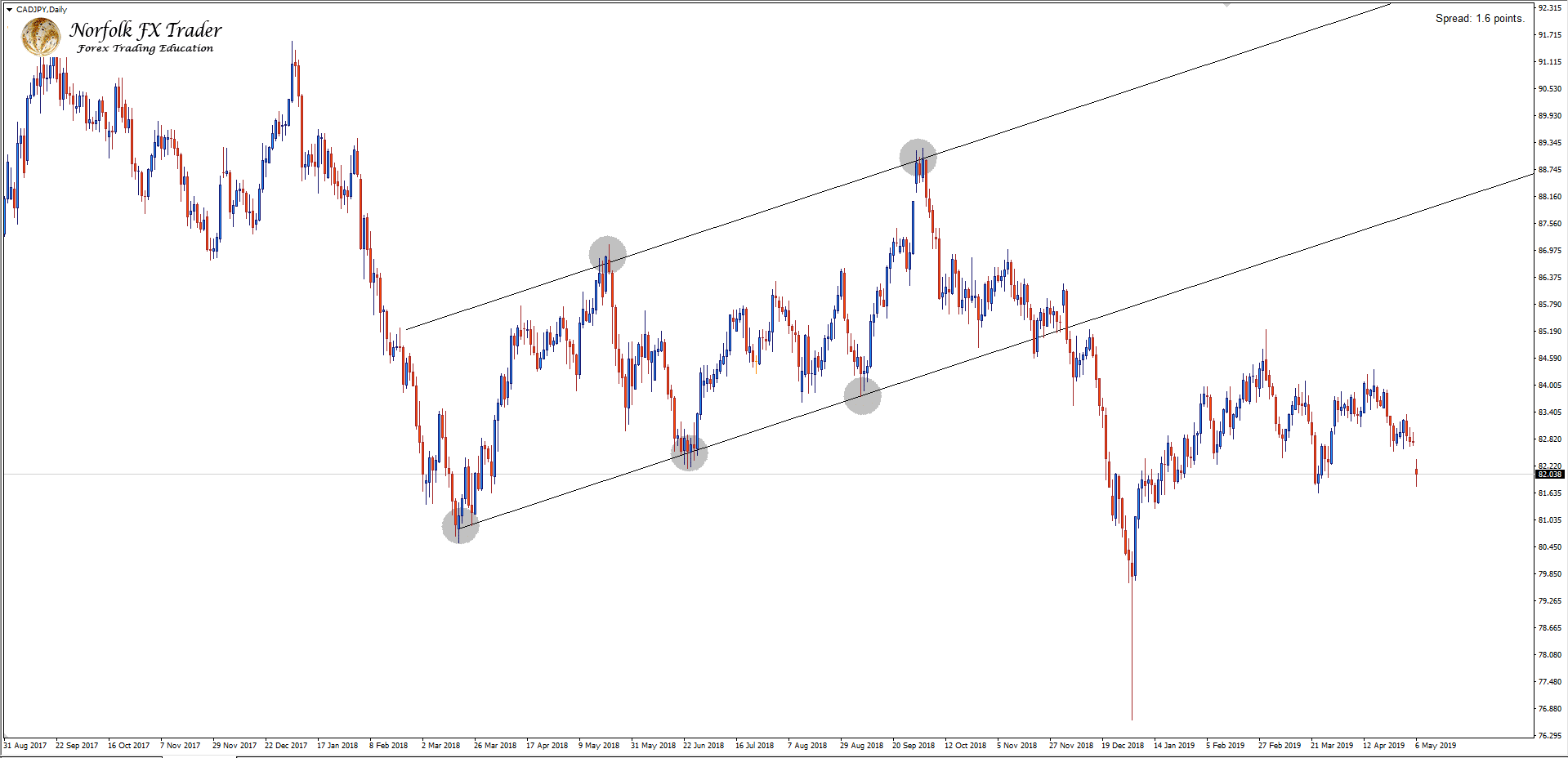

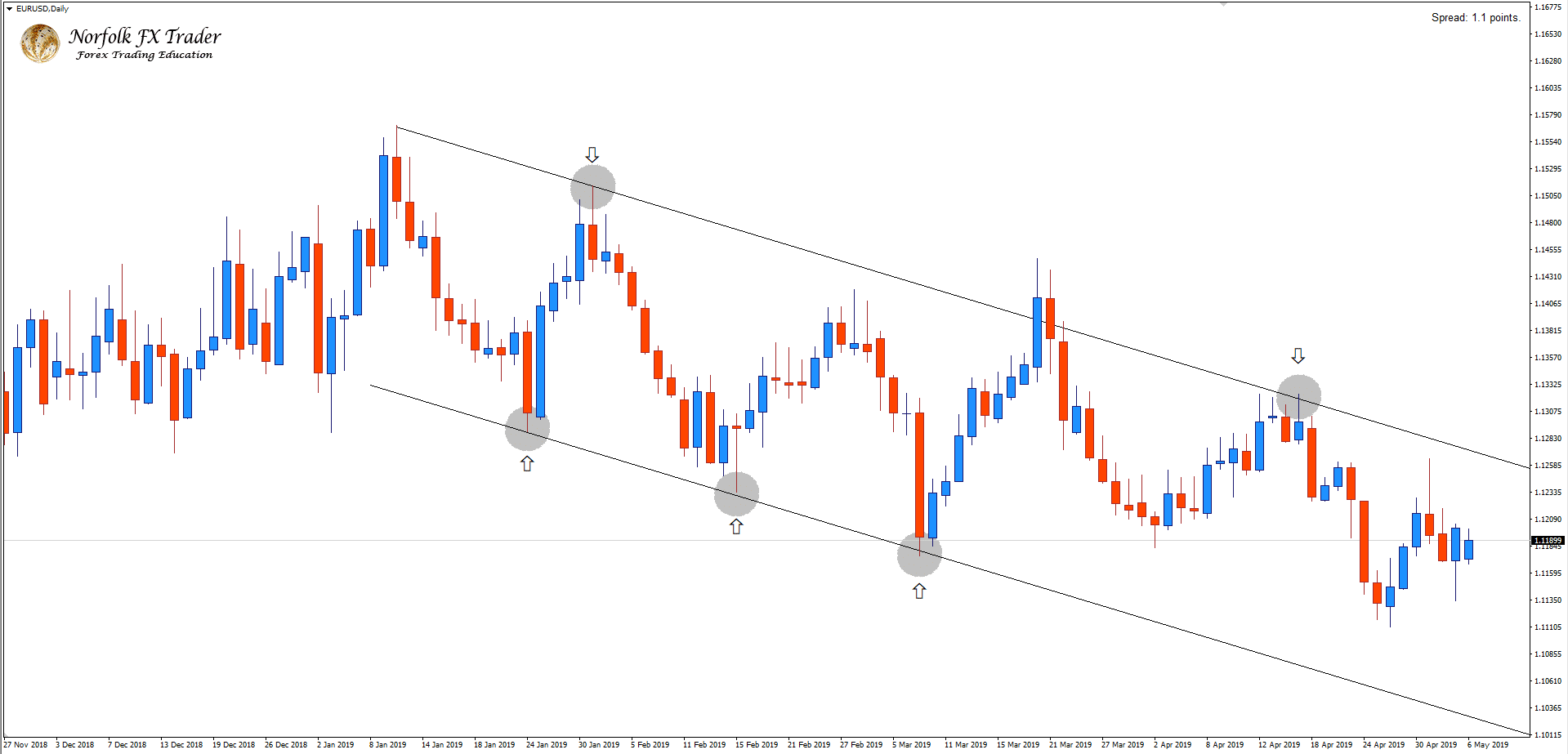

Notice on the chart above, how I have drawn the Ascending channel levels incorrectly. By placing the levels cutting off the wick highs and lows.

This is an example of what I see many traders do quite often.

Is there a right or wrong way to draw these structure levels?

That’s a good question, and the above channel is in fact entirely valid. So why am I saying it is not correctly drawn. It all comes down to the precision of the structure level placement. The above chart is the type of structure you should be looking to trade.

However, the levels need to be drawn with more precision, therefore giving you a higher success rate with trading the patterns.

Lets look at how I draw a ascending channel correctly.

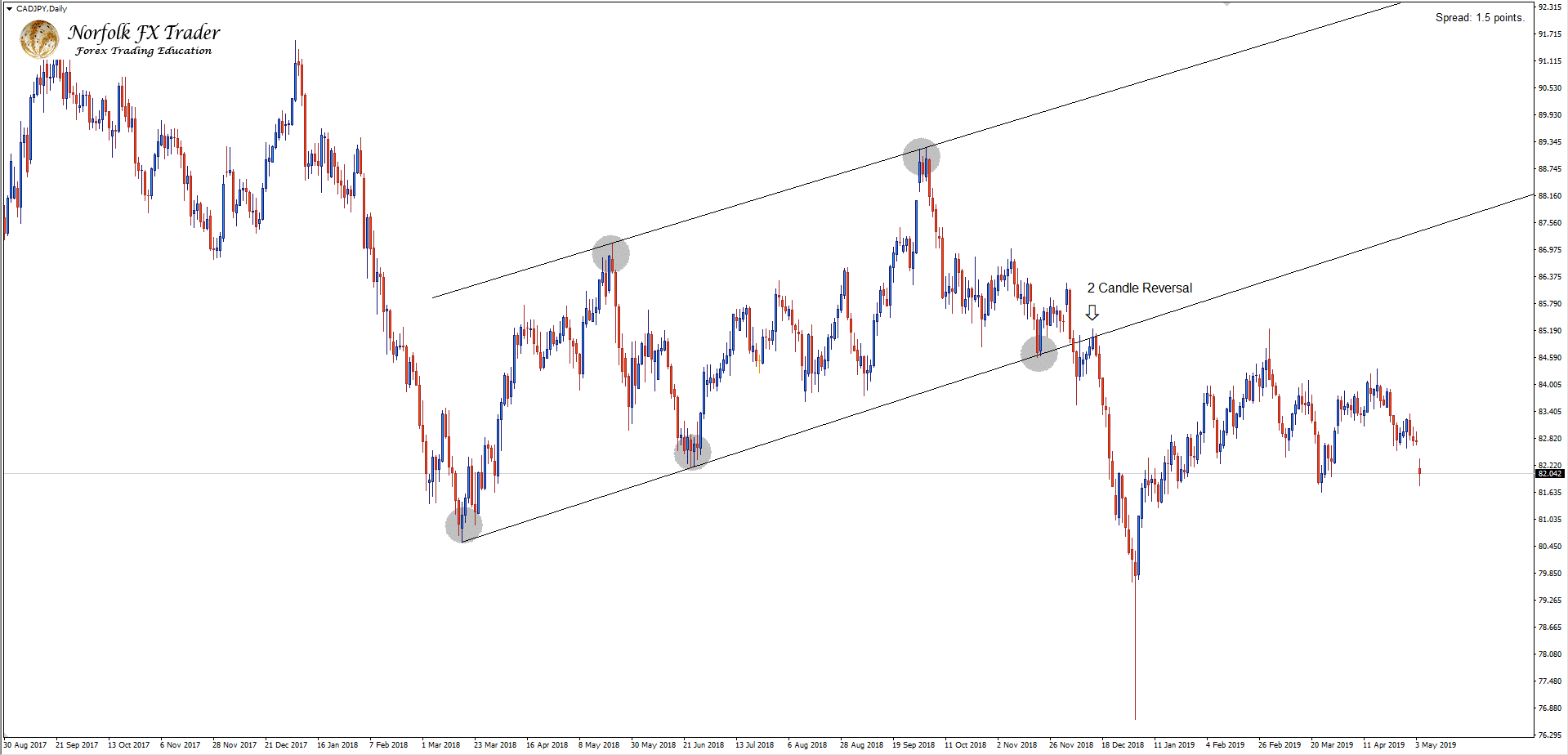

Lines Up Perfectly…

On the chart above you can see this time I have drawn the structure levels so they line up with the highs and lows perfectly.

The best part,

Even though the two chart differences may look like a minor detail. If you was to look closer you will see on the 2nd chart there is a retest of the broken channel.

This is where one trader benefits with trading in this style of marking the pattern correctly. Where the other trader may find frustration, and potential missed trades or even losing trades.

Hopefully you can see how this minor mistake can cause you problems with your own trading. Not many traders will think this makes much difference, but you now know it does!

More extreme example with Forex market trading technical patterns

The example above was mild compared to what I have seen, with this mistake. Lets now look at how drawing these levels correctly shows why it works.

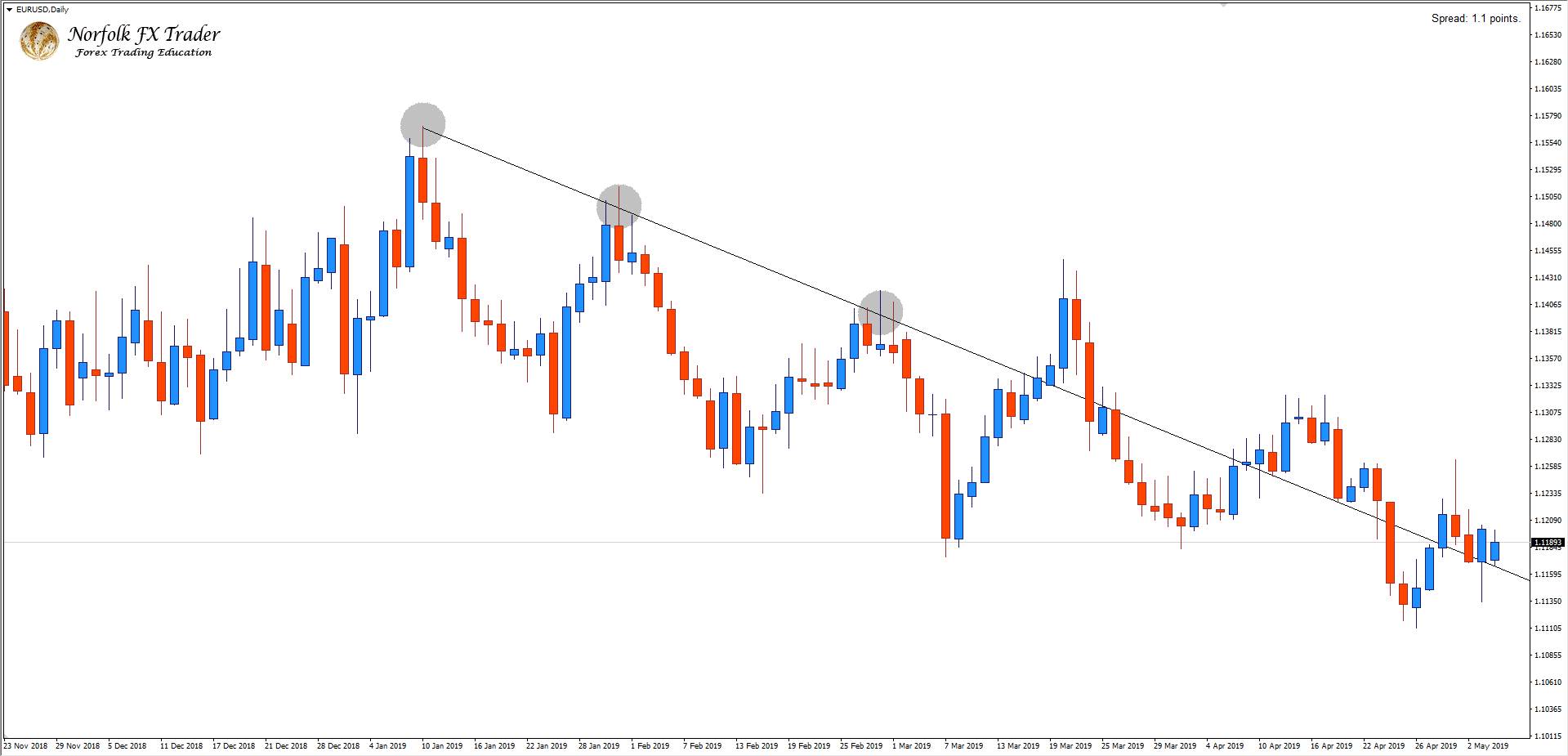

On the chart of the EURUSD Daily above, I have drawn a bearish trend line. You will see I have drawn this incorrectly with a swing high being cut off.

How would you have drawn this?

I’m hoping now, you are getting the correct way to draw out these structure levels with technical patterns.

Here is the proper position of this bearish trend line.

Besides the fact this trend line now isn’t cutting of the swing high, there was something else at play here as well. Which tipped me off to knowing the correct trend line placement.

By drawing now a Descending channel instead of a trend line will give you clarity of why this level should have been drawn correctly.

And I could see that the swing lows lined up to help me identify the precision of the resistance.

Another mistake traders will also make from drawing these technical patterns incorrectly. With seeing false breaks and trying to trade them at incorrect locations.

Where in fact they are not actual false breaks, why?

Because those individual traders failed to plot the correct levels. Putting them at an disadvantage when trading the patterns.

My Solution to this mistake:

So, to sum it up when ever marking out your levels with any technical pattern. Always make sure that you draw your support and resistance levels, in line with candlestick highs and lows.

Making sure you stick to this rule you won’t fall victim to any false breakout.

In other words, a close above or below a support or resistance will be a valid breakout. Not putting yourself into a losing position where the trade goes against you.

That said, you just won’t find every setup the same. Most likely you won’t find that every level lines up perfectly to extreme highs or lows.

It’s okay if every wick doesn’t line up with each level you have drawn. Most important is it captures each area without cutting out too many wick highs or lows.

14. Trading Too Soon!

Final mistake made with Forex market trading?

In this final mistake I see many traders making, with not confirming a technical pattern with an entry. Therefore, attempting to try and trade a Forex market trading entry. Before the pattern has actually fully formed, with a favourable entry!

Being able to identify price action patterns is great, but they won’t become profitable until you have learnt how to trade them efficiently.

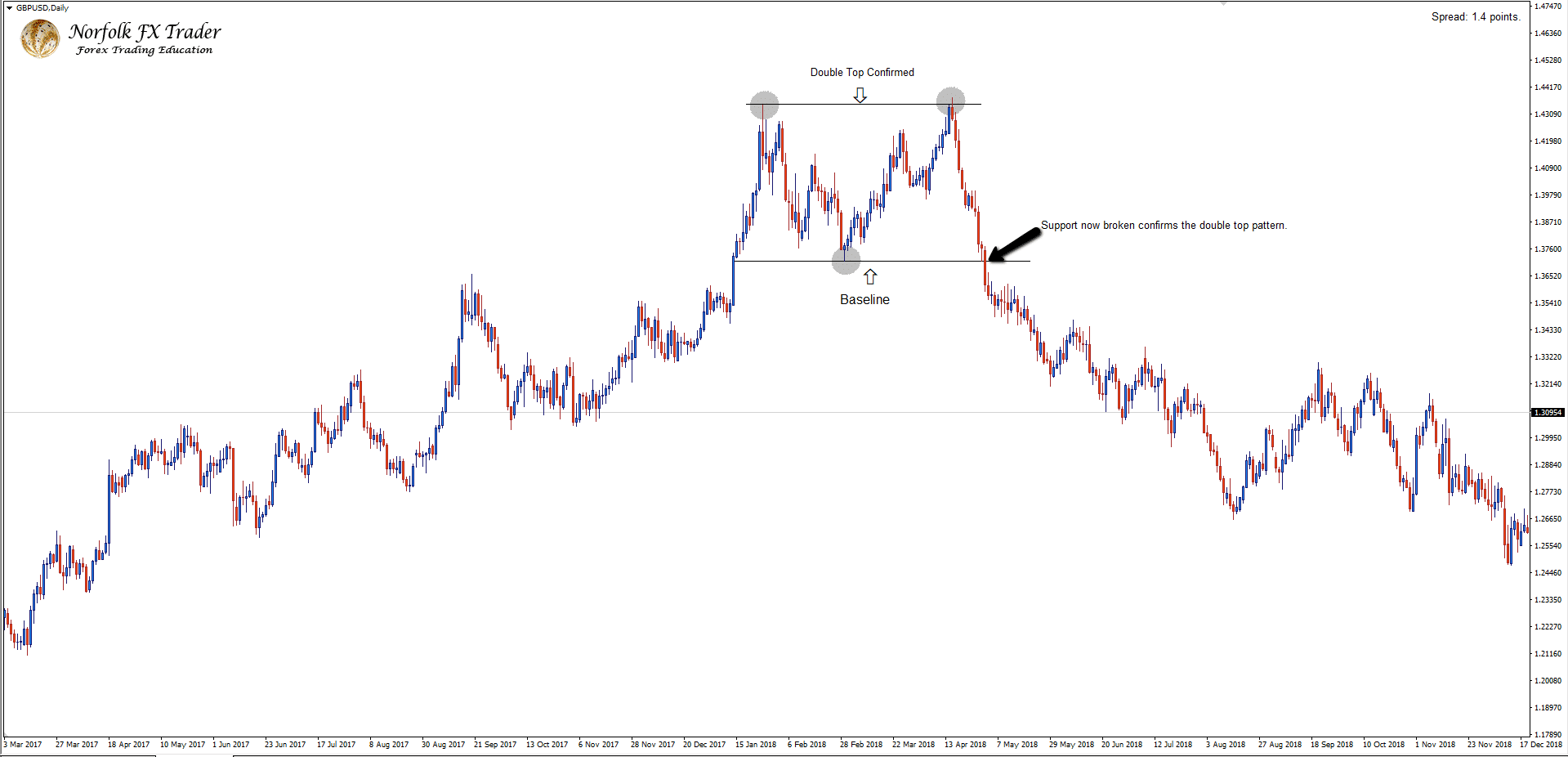

This won’t happen especially if you are trying to trade of structures you are marking that are unconfirmed! One great example I like to use, is with the double top and double bottom formations.

Which you can learn more about these two reversal price patterns, and turn your trading around by reading through a recent post I wrote here.

Neither structure levels are confirmed on this pattern until price actually breaks the baseline. Without price closing above or below this baseline, makes this structure insignificant.

What do I mean by this?

We’ll without the break and close of the baseline, I can’t actually confirm this as a double top or double bottom pattern.

Take the double top formation below as an example of this.

If you note at the current point of price on the GBPUSD chart above, price has not yet closed below the support.

So not only has this reversal not yet been confirmed, you can’t actually call this a double top pattern. One day later, the baseline is broken and confirms the reversal of the pattern.

I’m sure you have probably made this mistake at some point in the past, even I did when I first started out in Forex market trading.

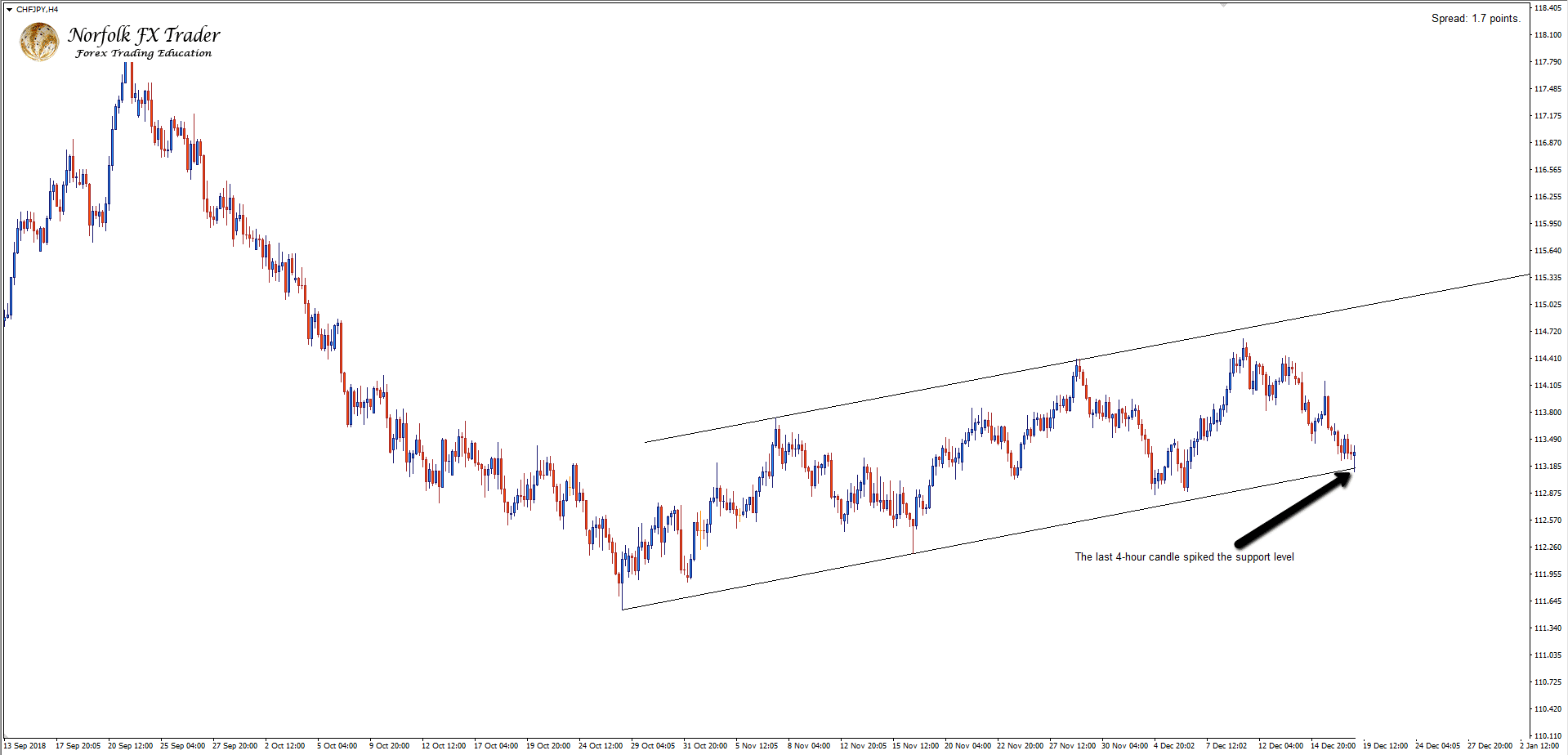

This isn’t just limited to reversal patterns, but any technical pattern would need to be confirmed in the same way. Take the descending channel I spoke about on the EURUSD in the previous mistake.

While trading the outer boundaries of the channel is often made, it’s not normally advisable or profitable.

Typically, waiting for the breakout to be confirmed is more advisable.

Lets now look at this on an example with a descending channel on the CHFJPY 4-hour time frame.

Becoming more confident!

When you start to become more confident and comfortable with placing your levels of support and resistance. It will then become a waiting game for the technical pattern you have marked out.

With the only thing that should catch your attention now is when there is a break and close of the support or resistance respectively.

It’s important you always wait for that close!

Never look at trading any pattern without the close, trying to trade these just solely on a break of the level isn’t good risk management.

The chart below will now demonstrate just this, with waiting for price to break the ascending channel support to confirm the pattern. Then knowing with more confidence you can search for a potential trade entry short.

It doesn’t matter if you’re trading a double top, or a double bottom, channels or even a head and shoulders pattern.

Or any other variation of a reversal or continuation pattern. The same rules apply to them all, waiting for a break and close to confirm the pattern first then searching for a entry.

My Solution to this mistake:

Of course, you already know what I am now going to say! Make sure you always wait for the breakout and close of the support or resistance level of the technical pattern you are watching.

Before ever considering an entry, this will therefore provide a greater confidence to any possible trade setup you might be watching.

Above all, it will help you towards the development of your trading discipline and patients with Forex market trading!

Why not check out the video below on how to read trends in the markets correctly. This will help you understand the movements of trends in better detail.

Turn Your Trading Around And Learn To Trade Naked Today!

I’m not saying you will be literally trading naked: But you will learn how I trade a naked price chart! Interested in learning a new skill and how to read raw price on the charts, then click here now.

Final thoughts

Regardless of how long you have been trading technical patterns with Forex market trading. If you make any one of these four mistakes outline above is going to be a sure way to losing your profits.

With becoming consistently profitable with trading, it will depend on the time frame of choice you are trading.

Trading the higher time frames, making sure you stay conservative with any trade entries you take.

Will have a massive outcome on your trading results!

Perhaps you have fallen into this trap of making these common mistakes. What’s important is you take away from my post today. Is you’ve recognised the problem, and you’re willing to correct the issue.

Just remember, to become a successful Forex trader you need to be disciplined and patient. Trading success doesn’t happen over night and the end game is what you are aiming for!